Paper: GS – III, Subject: Environment, Ecology and Disaster Management, Topic: Disaster Management, Issue: Strengthening disaster risk financing.

Context:

Disaster risk financing (DRF) in India faces severe challenges. It underscores the need for proactive, structured, and innovative financial mechanisms to build climate and disaster resilience.

Key Highlights:

Rising Vulnerability and Costs:

- Increasing Disaster Frequency: India faces recurrent disasters like cyclones, floods, landslides, and extreme rainfall.

- Economic Impact: Economic losses from disasters have been assessed upwards of ₹50,000 crores annually.

- Urbanization Woes: Poor urban planning has turned cities into flood traps.

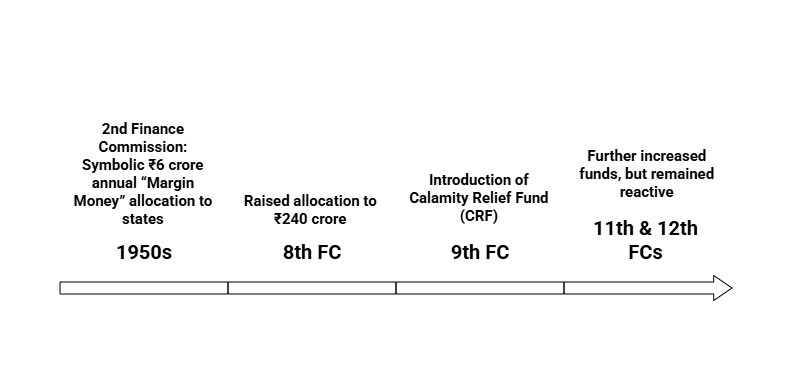

Disaster Financing in India:

Institutional Framework:

- Disaster Management Act, 2005: Provided legal backing for disaster governance.

- 13th FC: Institutionalized the National & State Disaster Response Funds (NDRF & SDRF).

- Introduced structured, rule-based financing for relief and response.

Innovations by the 15th Finance Commission:

- Timeframe: 2020–21 to 2025–26.

- Key Allocations: ₹1.6 trillion total, ₹68,000 crore to states, ₹45,000 crore for Centre.

- New Ideas:

- Build not Build Back approach.

- Adoption of Disaster Risk Index (DRI) for data-driven allocation.

- Incentives for welfare-linked risk reduction and resilient planning.

Limitations of Current System:

- Rapid Urbanization: Increased exposure to disasters.

- High Cost of Disasters: Often forces borrowing from multilateral institutions like MDBs.

- Delayed Relief: Current financing models lack the speed for immediate response.

- Neglected Area: Preparedness and mitigation remained underfunded.

Further measures needed:

- Risk Retention Tools: Contingency buffers and Emergency funds.

- Risk Transfer Models: Catastrophe risk pools and Sovereign insurance mechanisms.

- New Paradigms: Culture of self-protection and preparedness and Risk-informed planning for resilient infrastructure (housing, agriculture, etc.).

Conclusion:

Disaster risk financing is no longer just a humanitarian issue it’s about Fiscal prudence and Sovereignty over disaster recovery. It aligns with Prime Minister’s 10-point agenda, especially point 6 (financial preparedness) and point 9 (international cooperation).

La Excellence IAS Academy, the best IAS coaching in Hyderabad, known for delivering quality content and conceptual clarity for UPSC 2025 preparation.

FOLLOW US ON:

◉ YouTube : https://www.youtube.com/@CivilsPrepTeam

◉ Facebook: https://www.facebook.com/LaExcellenceIAS

◉ Instagram: https://www.instagram.com/laexcellenceiasacademy/

GET IN TOUCH:

Contact us at info@laex.in, https://laex.in/contact-us/

or Call us @ +91 9052 29 2929, +91 9052 99 2929, +91 9154 24 2140

OUR BRANCHES:

Head Office: H No: 1-10-225A, Beside AEVA Fertility Center, Ashok Nagar Extension, VV Giri Nagar, Ashok Nagar, Hyderabad, 500020

Madhapur: Flat no: 301, survey no 58-60, Guttala begumpet Madhapur metro pillar: 1524, Rangareddy Hyderabad, Telangana 500081

Bangalore: Plot No: 99, 2nd floor, 80 Feet Road, Beside Poorvika Mobiles, Chandra Layout, Attiguppe, Near Vijaya Nagara, Bengaluru, 560040