Paper: GS – III, Subject: Economy, Topic: Taxation, Issue: GST Reforms.

Context:

The 56th GST Council meeting (Sept 3, 2025) marks a milestone in India’s tax history.It aims at major reforms to simplify GST structure, reduce anomalies, and align Indian taxation with global practices.

Key Highlights:

Key Reforms under GST 2.0

Simplified Rate Structure: Old slabs (5%, 12%, 18%, 28%) will be replaced with:

- Standard Rate: 18%

- Merit Rate: 5%

- De-merit Rate: 40% (for select items)

- Move towards a transparent “Simple Tax” system.

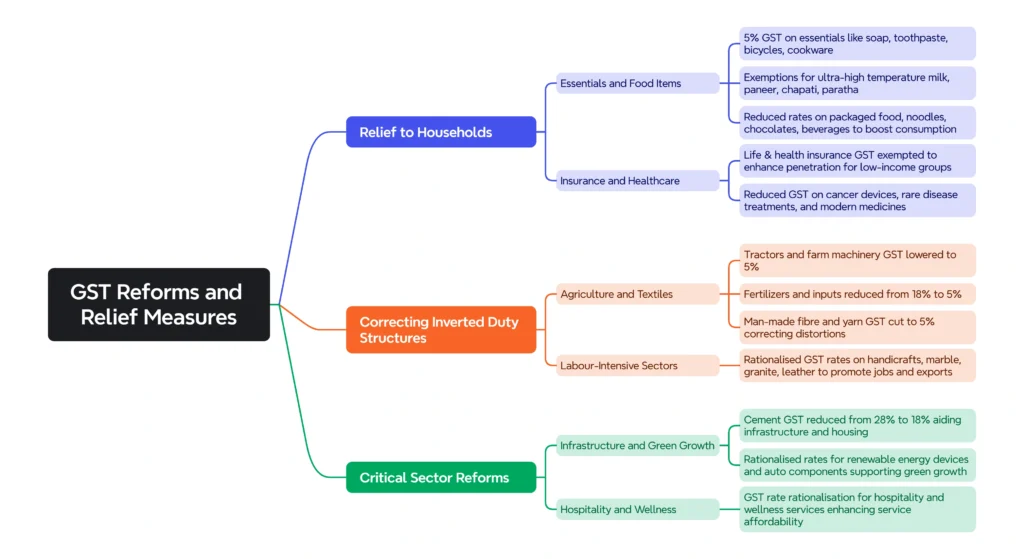

GSt Reforms and Relief Measures:

Institutional & Process Reforms:

- Establishment of Goods & Services Tax Appellate Tribunal (GSTAT) by end of 2025.

- Provisional refunds for inverted duty structures.

- Harmonisation of valuation rules.

- Faster dispute resolution, consistent rulings, reduced compliance burden.

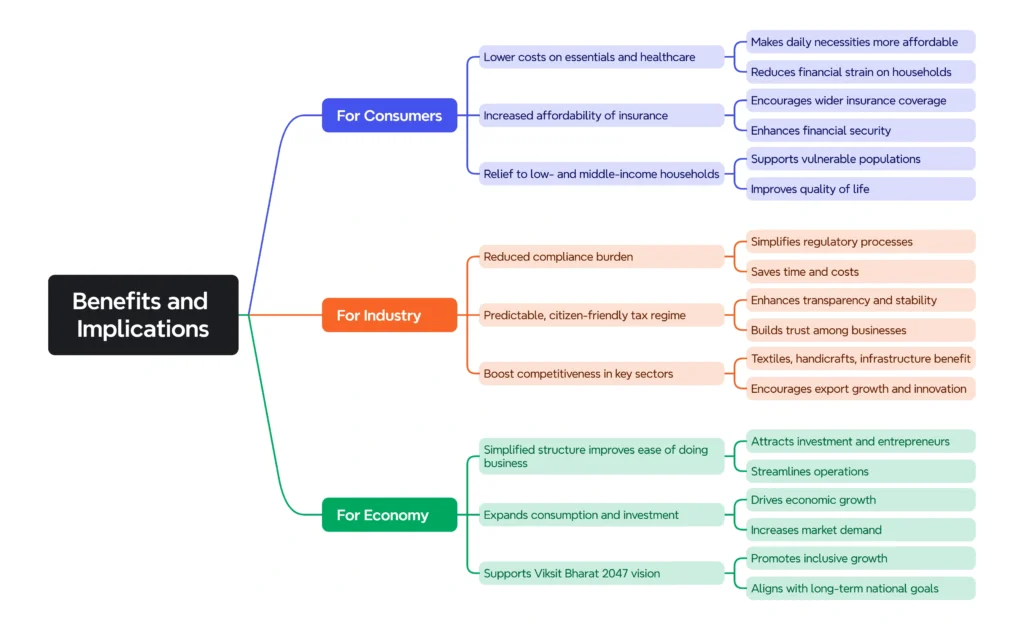

Benefits & Implications:

Conclusion:

GST 2.0 is more than a tax reform. By simplifying rates, correcting anomalies, and institutionalising dispute resolution, it strengthens India’s fiscal stability while promoting consumption, investment, and employment.

La Excellence IAS Academy, the best IAS coaching in Hyderabad, known for delivering quality content and conceptual clarity for UPSC 2025 preparation.

FOLLOW US ON:

◉ YouTube : https://www.youtube.com/@CivilsPrepTeam

◉ Facebook: https://www.facebook.com/LaExcellenceIAS

◉ Instagram: https://www.instagram.com/laexcellenceiasacademy/

GET IN TOUCH:

Contact us at info@laex.in, https://laex.in/contact-us/

or Call us @ +91 9052 29 2929, +91 9052 99 2929, +91 9154 24 2140

OUR BRANCHES:

Head Office: H No: 1-10-225A, Beside AEVA Fertility Center, Ashok Nagar Extension, VV Giri Nagar, Ashok Nagar, Hyderabad, 500020

Madhapur: Flat no: 301, survey no 58-60, Guttala begumpet Madhapur metro pillar: 1524, Rangareddy Hyderabad, Telangana 500081

Bangalore: Plot No: 99, 2nd floor, 80 Feet Road, Beside Poorvika Mobiles, Chandra Layout, Attiguppe, Near Vijaya Nagara, Bengaluru, 560040