Paper: GS – III, Subject: Indian Economy, Topic: Financial Market, Issue: Catastrophe Bonds.

Context:

India is one of the world’s most disaster-prone countries, facing recurrent cyclones, floods, droughts, earthquakes, and extreme heat events.

Key Highlights:

- These disasters impose huge fiscal burdens on the government, which must finance relief, rehabilitation, and reconstruction.

- Traditional insurance mechanisms have proved inadequate due to the widening climate protection gap, rising premiums, and limited coverage.

Catastrophe Bonds: A Solution for Risk Transfer:

- Definition: Cat bonds are insurance-linked securities that transfer the financial risk of natural disasters from insurers or governments to private investors.

- Mechanism: Investors receive higher interest payments, but their principal is at risk. If a predefined catastrophic event occurs, part or all of the principal is used to cover losses.

- Benefits:

- Access to Capital Markets: Cat bonds tap into the deep pockets of global capital markets.

- Faster Payouts: Parametric triggers based on objective, measurable events (e.g., wind speed, earthquake intensity) enable quicker payouts compared to traditional insurance claims.

- Fiscal Stability: By securing pre-arranged funding, governments can protect public expenditure and avoid fiscal shocks associated with major disaster recovery efforts.

- Global Adoption: Cat bonds are currently used in Japan, Europe, the US, Mexico, the Philippines, and other countries. The World Bank Group has issued multi-country cat bonds for 16 Caribbean countries. The global value of outstanding cat bonds is approximately $56 billion.

- Premium: Globally, the premium in 2025 ranged from 6.3% to 11.3%, depending on the risks.

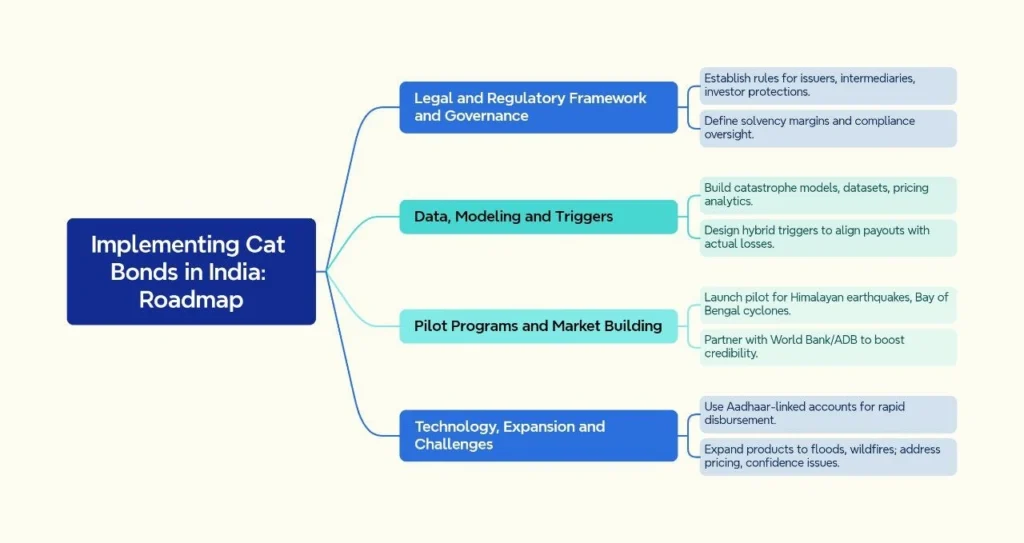

Implementing Cat Bonds in India: Roadmap:

India’s vulnerability to natural disasters necessitates innovative financial solutions to bridge the disaster-relief funding gap. By establishing a robust legal and regulatory framework, investing in data and modeling capabilities, and launching pilot programs, India can effectively leverage cat bonds to enhance its disaster resilience and reduce the fiscal burden on the government

La Excellence IAS Academy, the best IAS coaching in Hyderabad, known for delivering quality content and conceptual clarity for UPSC 2025 preparation.

FOLLOW US ON:

◉ YouTube : https://www.youtube.com/@CivilsPrepTeam

◉ Facebook: https://www.facebook.com/LaExcellenceIAS

◉ Instagram: https://www.instagram.com/laexcellenceiasacademy/

GET IN TOUCH:

Contact us at info@laex.in, https://laex.in/contact-us/

or Call us @ +91 9052 29 2929, +91 9052 99 2929, +91 9154 24 2140

OUR BRANCHES:

Head Office: H No: 1-10-225A, Beside AEVA Fertility Center, Ashok Nagar Extension, VV Giri Nagar, Ashok Nagar, Hyderabad, 500020

Madhapur: Flat no: 301, survey no 58-60, Guttala begumpet Madhapur metro pillar: 1524, Rangareddy Hyderabad, Telangana 500081

Bangalore: Plot No: 99, 2nd floor, 80 Feet Road, Beside Poorvika Mobiles, Chandra Layout, Attiguppe, Near Vijaya Nagara, Bengaluru, 560040