Paper: GS – II, Subject: Polity, Topic: Legislature, Issue: Insurance Amendment Bill, 2025.

Context:

The Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Bill, 2025, recently approved by the Union Cabinet aims to modernize India’s insurance framework by amending the Insurance Act, 1938, the Life Insurance Corporation Act, 1956, and the Insurance Regulatory and Development Authority of India (IRDAI) Act, 1999.

Key Provisions of the Bill:

100% Foreign Direct Investment (FDI):

- Increase in FDI Limit: The bill proposes raising the FDI limit in Indian insurance companies from 74% to 100%.

- Expected Benefits:

- Attract stable and sustainable investment.

- Facilitate technology transfer.

- Enhance insurance penetration and social protection.

- Help achieve the goal of “Insurance for All by 2047.”

- Enable insurers to access long-term capital, advanced risk-management expertise, global best practices, and cutting-edge technology.

- Expand insurance coverage.

Standard Operating Procedures (SOPs) for Foreign Reinsurers:

- Reduction in Net Owned Funds Requirement: The bill proposes reducing the Net Owned Funds requirement for foreign reinsurers from ₹5,000 crore to ₹1,000 crore.

- Expected Benefits:

- Facilitate the entry of more reinsurers.

- Build greater reinsurance capacities in the country.

- Broaden competition in a segment currently dominated by the public sector GIC Re.

- Attract smaller and new-age reinsurers to India.

Enhanced Powers for IRDAI:

- Increased Enforcement Powers: The IRDAI will receive enhanced enforcement powers, including the authority to disgorge wrongful gains made by insurers or intermediaries.

- Expected Benefits:

- Strengthen policyholder protection.

- Bring IRDAI’s punitive capabilities closer to that of SEBI.

- Raise the threshold for requiring IRDAI’s approval for the transfer of paid-up equity capital in insurance companies from 1% to 5%.

- Incorporate a formal standard operating procedure (SOP) for regulation-making into the Act.

- Greater Autonomy for LIC:

- LIC allowed to open offices without prior government approval.

- Overseas operations aligned with host-country regulations.

- Improves efficiency, global compliance, and competitiveness.

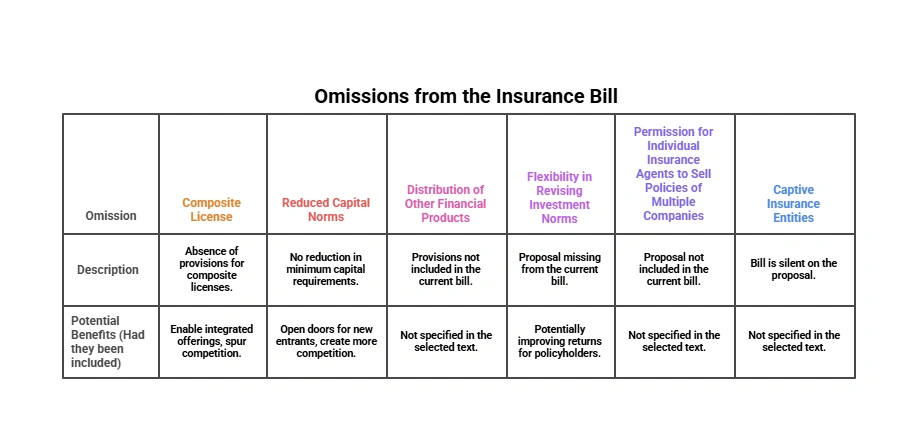

Omissions from the Insurance Bill:

It represents a significant step towards modernizing India’s insurance sector. The increase in the FDI limit to 100%, the reduction in Net Owned Funds requirements for foreign reinsurers, the enhanced powers for IRDAI, and the greater operational freedom for LIC are all positive developments that are expected to attract investment, promote competition, and improve policyholder protection.

La Excellence IAS Academy, the best IAS coaching in Hyderabad, known for delivering quality content and conceptual clarity for UPSC 2025 preparation.

FOLLOW US ON:

◉ YouTube : https://www.youtube.com/@CivilsPrepTeam

◉ Facebook: https://www.facebook.com/LaExcellenceIAS

◉ Instagram: https://www.instagram.com/laexcellenceiasacademy/

GET IN TOUCH:

Contact us at info@laex.in, https://laex.in/contact-us/

or Call us @ +91 9052 29 2929, +91 9052 99 2929, +91 9154 24 2140

OUR BRANCHES:

Head Office: H No: 1-10-225A, Beside AEVA Fertility Center, Ashok Nagar Extension, VV Giri Nagar, Ashok Nagar, Hyderabad, 500020

Madhapur: Flat no: 301, survey no 58-60, Guttala begumpet Madhapur metro pillar: 1524, Rangareddy Hyderabad, Telangana 500081

Bangalore: Plot No: 99, 2nd floor, 80 Feet Road, Beside Poorvika Mobiles, Chandra Layout, Attiguppe, Near Vijaya Nagara, Bengaluru, 560040