Context:

Finance Minister Nirmala Sitharaman presented Union Budget 2026-27 on 1 February, marking her ninth consecutive budget address. It outlines the government’s plan for income and spending for the financial year 2026-27 (April 2026 to March 2027). The Budget focuses on economic growth, infrastructure development, and welfare of citizens.

Key Takeaways:

What is the Union Budget of India?

- The Union Budget is the annual financial statement of the Government of India. According to Article 112 of the Indian Constitution, the government is required to present a statement of estimated receipts and expenditure for every financial year (April 1 to March 31).

- Note: Interestingly, the word “Budget” is never actually mentioned in the Constitution; it is officially termed the Annual Financial Statement (AFS).

India’s Budget History

- First Ever Budget: Presented on April 7, 1860, by James Wilson (British India).

- First Budget of Independent India: Presented on November 26, 1947, by R.K. Shanmukham Chetty.

- The Black Budget (1973-74): Presented by Yashwantrao B. Chavan, it had a massive deficit of ₹550 crore.

- The Epochal Budget (1991): Manmohan Singh introduced LPG (Liberalization, Privatization, and Globalization) reforms.

- The Digital Shift: In 2021, Finance Minister Nirmala Sitharaman presented the first Paperless Budget using a digital tablet.

Union Budget Constitutional Provisions:

| Article | Provision | Explanation |

| Article 112 | Annual Financial Statement | Mandates the presentation of the Union Budget showing estimated receipts and expenditures of the Government of India for the financial year. |

| Article 113 | Voting on Demands for Grants | Requires Lok Sabha approval for all expenditure demands of ministries; Rajya Sabha has no voting power. |

| Article 114 | Appropriation Bill | Authorizes withdrawal of money from the Consolidated Fund of India after demands are passed. |

| Article 110 | Money Bill | Contains tax proposals; can be introduced only in Lok Sabha and cannot be rejected by Rajya Sabha |

| Article 109 | Role of Rajya Sabha | Rajya Sabha can only discuss the Budget and must return Money Bills within 14 days |

| Article 111 | Presidential Assent | Budget becomes law only after President gives assent to Appropriation and Finance Bills. |

| Article 116 | Vote on Account | Allows government to meet expenses temporarily if Budget is not passed in time. |

Economic Stability: Over the past twelve years, India has demonstrated macroeconomic stability marked by fiscal prudence and controlled inflation.

Viksit Bharat Vision: The government continues to prioritise structural reforms and sustained public investment to achieve the goal of becoming a developed nation.

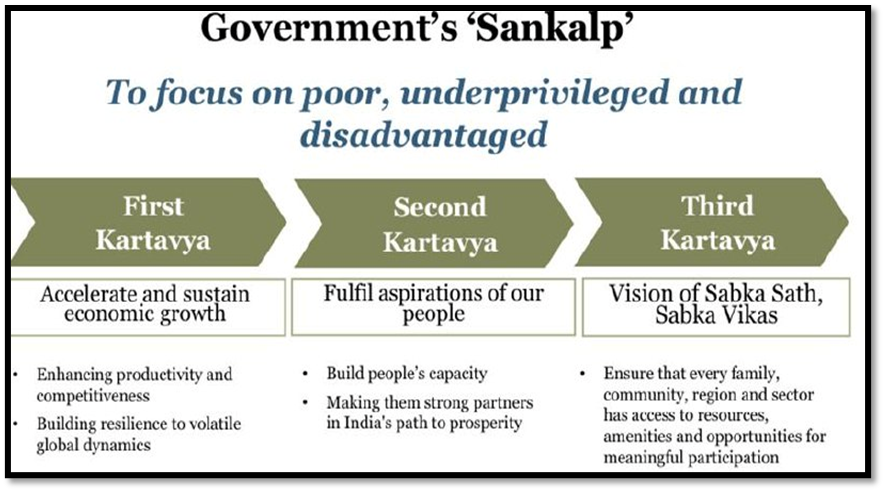

Three Kartavyas:

Growth Performance: Recent policy initiatives have resulted in an economic growth rate of around 7 per cent.

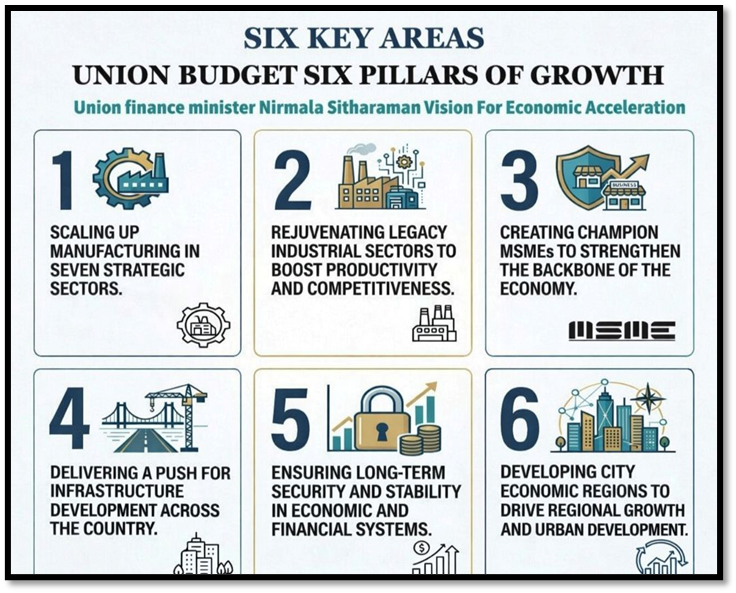

The Reform Express:

- Post-2025 Reforms: Over 350 reforms have been rolled out since August 2025, including GST simplification and Labour Code notifications.

- 6 Strategic Areas: The government is targeting manufacturing, legacy clusters, MSMEs, infrastructure, energy security, and City Economic Regions.

Scaling up Manufacturing: Strategic Focus Areas:

- Biopharma SHAKTI: An allocation of ₹10,000 crore over five years has been earmarked to strengthen biologics and biosimilars. The initiative includes the establishment of three new and seven upgraded NIPERs, along with over 1,000 clinical trial sites.

- India Semiconductor Mission (ISM 2.0): Emphasis on developing domestic capabilities in semiconductor equipment, materials, and indigenous intellectual property–based chip design.

- Electronics Manufacturing: The outlay under the Electronics Components Manufacturing Scheme has been enhanced to ₹40,000 crore to deepen component-level manufacturing.

- Rare Earth Corridors: Dedicated mining and processing hubs will be developed in Odisha, Kerala, Andhra Pradesh, and Tamil Nadu to secure critical mineral supply chains.

- Chemical Parks: 3 dedicated parks to be established via a challenges route cluster model.

- Capital Goods Sector: Scheme for Container Manufacturing: A ₹10,000 crore investment over five years to create a globally competitive container manufacturing ecosystem.

- Textile Sector:

- National Fibre Scheme: Promotion of natural fibres (silk, wool, jute) alongside man-made fibres.

- Tex-Eco Initiative: Encouraging sustainable and globally competitive apparel production.

- Samarth 2.0: Upgradation of the textile skilling framework.

- Mega Textile Parks: Development of large-scale parks for technical textiles through a challenge-based approach.

- Khadi and Sports Goods: Launch of Mahatma Gandhi Gram Swaraj to integrate Khadi with global value chains, along with a focused push for high-quality sports goods manufacturing.

Legacy Clusters and Champion MSMEs:

- Cluster Revitalisation: Around 200 traditional industrial clusters will be modernised through targeted technology upgradation.

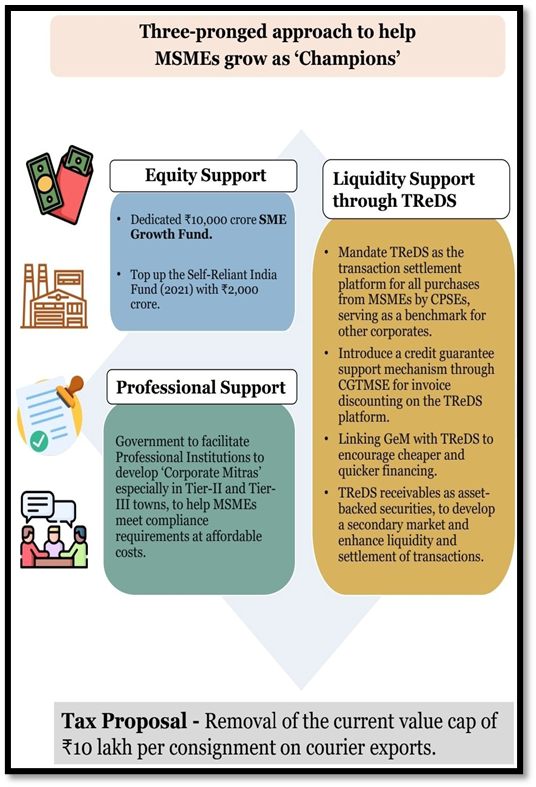

- Financing Support for MSMEs:

- Small and Medium Enterprise Growth Fund: A dedicated fund of ₹10,000 crore to support the expansion of small and medium enterprises.

- Self-Reliant India Fund: An additional ₹2,000 crore infusion to strengthen micro-enterprise financing.

- Liquidity Enhancement (TReDS): Use of the Trade Receivables Discounting System (TReDS) will be made mandatory for all Central Public Sector Enterprise procurement from MSMEs, with integration into the GeM platform.

- Corporate Mitras: Development of trained para-professionals in Tier-II and Tier-III cities to assist MSMEs in regulatory compliance and business facilitation.

Infrastructure, Logistics, and Energy:

- Public Capital Expenditure: Government capital spending has been enhanced to ₹12.2 lakh crore for FY 2026–27, reinforcing growth through infrastructure-led development.

- Risk Mitigation: An Infrastructure Risk Guarantee Fund will be established to provide credit guarantees and improve lender confidence in infrastructure projects.

- Logistics Expansion:

- Freight Corridors: Development of new freight corridors linking Dankuni in the East with Surat in the West to strengthen east–west connectivity.

- New Dedicated Freight Corridors, 20 New National Waterways, and coastal cargo promotion.

- ₹2 lakh crore support to states under SASCI Scheme

- Inland Waterways: Notification of 20 new National Waterways, with NW-5 in Odisha to be operationalised on priority. Ship repair and maintenance hubs will be set up at Varanasi and Patna.

- Coastal and Riverine Cargo: A promotion scheme aims to raise the share of inland water transport to 12% by 2047.

- Aviation Sector: Incentives will be provided to indigenise seaplane manufacturing, along with the introduction of a Viability Gap Funding (VGF) scheme for seaplane operations.

- Clean Energy (CCUS): An allocation of ₹20,000 crore over five years has been made for Carbon Capture, Utilisation and Storage (CCUS) projects in the power, steel, and cement sectors.

- Basic Customs Duty exemptions for lithium-ion batteries, solar glass, nuclear projects (extended till 2035), and critical minerals.

- Excise duty relief on biogas-blended CNG to promote clean energy

- City Economic Regions (CERs): Tier-II and Tier-III cities will be mapped and developed as economic regions, with ₹5,000 crore earmarked per CER.

- 7 High-Speed Rail Corridors as growth connectors between cities: Mumbai to Pune, Pune to Hyderabad, Hyderabad to Bengaluru, Hyderabad to Chennai, Chennai to Bengaluru, Delhi to Varanasi and Varanasi to Siliguri.

Financial Sector and E-Business:

- Banking Reforms: A High-Level Committee on Banking for Viksit Bharat will be constituted to undertake a comprehensive review of the banking sector.

- NBFC Reforms: Structural restructuring of key non-banking financial institutions, including the Power Finance Corporation and the Rural Electrification Corporation, to enhance efficiency and financial resilience.

- Bond Market Development: Introduction of a market-making framework for corporate bonds, along with incentives worth ₹100 crore to encourage issuance of high-value municipal bonds.

- Foreign Investment: Resident individuals outside India (PROI) can now invest up to 10% (up from 5%) in listed Indian companies.

Second Kartavya: Education, Health, and Tourism

- Education–Employment Linkage: A High-Powered Standing Committee will steer the services sector with the objective of achieving a 10% share in global services trade.

- Health Sector Initiatives:

- Allied Health Professionals (AHPs): Upgradation of training institutions to create an additional 1 lakh specialised professionals.

- Care Ecosystem: Skill development of 1.5 lakh multi-skilled caregivers, with a focus on geriatric care.

- Medical Tourism: Establishment of five regional medical tourism hubs through public–private partnerships.

- AYUSH Promotion: Setting up three new All India Institutes of Ayurveda and strengthening the WHO Global Centre for Traditional Medicine.

- Animal Husbandry: Introduction of a loan-linked capital subsidy to support 20,000 new veterinary professionals.

- Creative Economy: Creation of AVGC Content Creator Labs in 15,000 schools and 500 colleges to nurture talent in animation, visual effects, gaming, and comics.

- STEM Education Support: Construction of one girls’ hostel in every district to enhance female participation in STEM disciplines.

- Tourism Development:

- Digital Infrastructure: Launch of a National Destination Digital Knowledge Grid to digitally document and showcase cultural and tourist sites.

- Adventure Tourism: Development of mountain trails in Himachal Pradesh, Uttarakhand, and Jammu & Kashmir, turtle trails in Odisha and Kerala, and designated bird-watching circuits.

- Heritage Tourism: Upgradation of 15 archaeological sites, including Lothal and Sarnath, into immersive, experience-based destinations.

- Sports Development: Launch of the Khelo India Mission aimed at transforming India’s sports ecosystem over the next decade.

Third Kartavya Agriculture and Inclusion:

The government aims to modernize the agricultural sector through a mix of diversification, technology, and branding:

- Fisheries: A major initiative will be launched to develop 500 reservoirs to support the fisheries sector.

- High-Value & Cash Crops: Targeted support will be provided for cultivating high-return crops such as coconut, sandalwood, walnuts, almonds, and Agar trees in the North-East.

- Global Branding: Special emphasis is being placed on Cashew and Cocoa, with a strategic goal to elevate them to global brand status by 2030.

- Technological Integration: The introduction of Bharat-VISTAAR, an AI-driven tool, will provide farmers with customized advisory services to improve productivity.

Social Empowerment & Healthcare:

Several initiatives are designed to uplift women, the differently-abled, and mental health infrastructure:

- Women’s Empowerment: Establishment of SHE-Marts (Self-Help Entrepreneur Marts) to create retail opportunities specifically for rural women entrepreneurs.

- Support for Divyangjan (Persons with Disabilities):

- Kaushal Yojana: Focused skill development in high-demand sectors like IT, Hospitality, and AVGC (Animation, Visual Effects, Gaming, and Comics).

- Sahara Yojana: Scaling up the manufacturing and distribution of assistive devices through ALIMCO.

- Mental Health Infrastructure: Expansion of mental healthcare access by establishing NIMHANS-2 in North India and upgrading existing institutes in Ranchi and Tezpur.

Strategic Regional Development (Purvodaya):

A focused push to develop Eastern and North-Eastern India includes:

- Infrastructure & Transit: Development of the East Coast Industrial Corridor and the deployment of 4,000 new e-buses across Purvodaya states to improve connectivity.

- Tourism & Culture: A new scheme to develop Buddhist Circuits, specifically highlighting Arunachal Pradesh, Sikkim, and other North-Eastern regions.

Part: B: Tax Reforms and Amendments Income Tax Act, 2025

- Structural Overhaul: The comprehensive review of the Income Tax Act, 1961 has been completed, and the Income Tax Act, 2025 will come into force from 1 April 2026.

- Revised Filing Timelines:

- (Income Tax Return)ITR-1 and ITR-2: Due date remains 31 July.

- Non-audit business cases and trusts: Due date extended to 31 August.

- Revised Returns: The window for filing revised returns is extended from 31 December to 31 March following the assessment year, subject to a nominal fee.

Ease of Living and Individual Taxpayer Relief:

- MACT Compensation: Interest awarded by the Motor Accident Claims Tribunal to individuals is fully exempt from income tax, and corresponding TDS provisions are withdrawn.

- Travel and Education under (Liberalised Remittance Scheme) LRS:

- Overseas tours: TCS on tour packages is slashed from 5%/20% to a flat 2%.

- Education and medical remittances: TCS under LRS reduced from 5% to 2%.

- Manpower Services: Explicitly brought under Payment to Contractors for TDS to avoid ambiguity; rates will be only 1% or 2%.

- Automated Lower TDS: Small taxpayers can now get lower or nil deduction certificates through a rule-based automated process rather than manual applications.

- FAST-DS (Foreign Assets Disclosure Scheme): A one-time six-month compliance window for students, professionals, and returning NRIs to declare overseas assets—

- up to ₹1 crore (Category A) or up to ₹5 crore (Category B) with immunity from prosecution.

Corporate Taxation, IT Sector, and Global Investment:

- IT Safe Harbour Regime:

- Software, KPO, and R&D services consolidated under a single category with a uniform 15.5% safe harbour margin.

- Eligibility threshold enhanced from ₹300 crore to ₹2,000 crore.

- Data Centre Incentives: Foreign firms providing global cloud services through Indian data centres will receive a tax holiday up to 2047.

- Buyback Taxation: Share buybacks will be taxed as capital gains in the hands of shareholders, with higher effective rates for promoters to curb arbitrage.

Securities Transaction Tax (STT): It is a direct tax charged on the purchase and sale of securities listed on the recognized stock exchanges in India

- Higher STT on commodity futures (0.02% → 0.05%).

- STT on Options: 0.15% (up from 0.1%/0.125%).

Minimum Alternate Tax is a tax mechanism intended to guarantee that businesses, particularly those who make significant profits, pay the government a minimum amount of tax.

- Minimum Alternate Tax reduced15% to 14%.

Indirect Taxes and Customs Reforms:

- Health Relief: Full customs duty exemption granted on 17 cancer drugs and 7 medicines for rare diseases.

- Personal Imports: Customs duty on dutiable personal imports reduced from 20% to 10%.

- E-commerce Exports: Removal of the ₹10 lakh consignment cap for courier exports to promote small exporters.

- Fisheries: Fish catch by Indian vessels within the Exclusive Economic Zone (EEZ) made customs-duty free.

- Customs Integrated System (CIS): A unified, scalable digital customs platform will be implemented within two years to automate end-to-end processes.

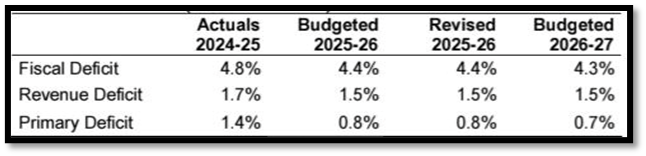

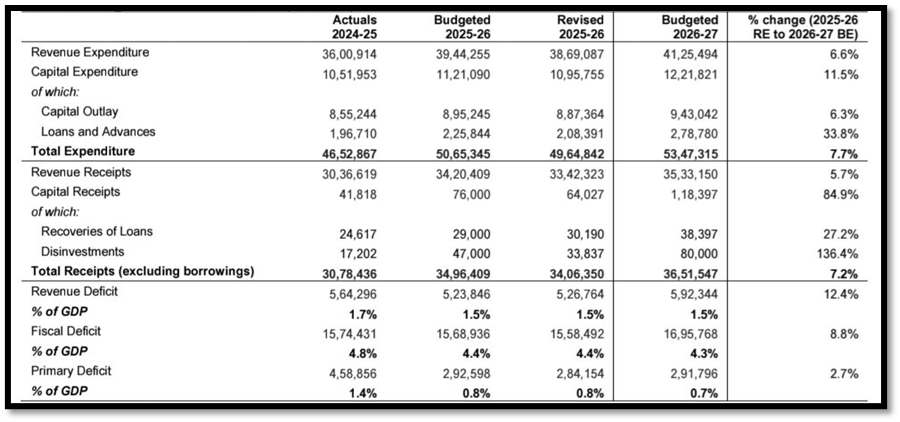

| Union Budget 2026–27: Key Fiscal Estimates: Receipts and Expenditure: Non-debt receipts are estimated at ₹36.5 lakh crore. Total expenditure is projected at ₹53.5 lakh crore. Centre’s net tax receipts are estimated at ₹28.7 lakh crore. Borrowings: Gross market borrowings are pegged at ₹17.2 lakh crore. Net market borrowings from dated securities are estimated at ₹11.7 lakh crore. Revised Estimates for 2025–26: Non-debt receipts stand at ₹34 lakh crore, with net tax receipts of ₹26.7 lakh crore. Total expenditure is revised to ₹49.6 lakh crore, including capital expenditure of about ₹11 lakh crore. Deficits (as % of GDP): Fiscal Deficit = Total Expenditure- Total Receipts (excluding borrowings). Revenue deficit = Total revenue receipts – Total revenue expenditure. Primary Deficit =Fisca Deficit−Interest Payments. |

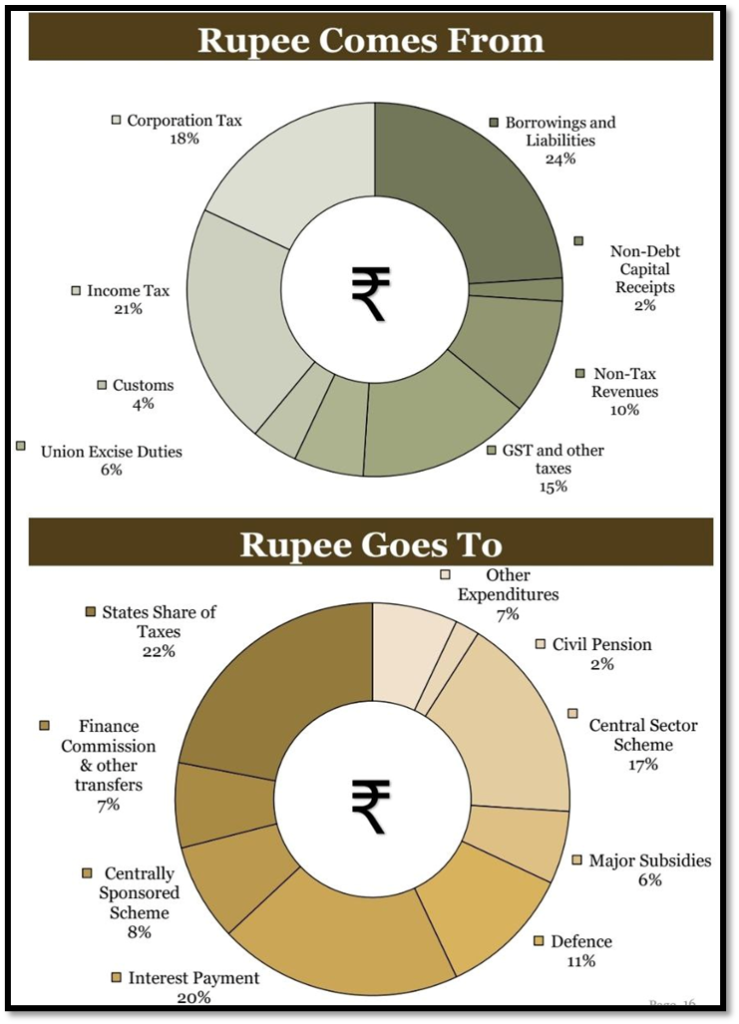

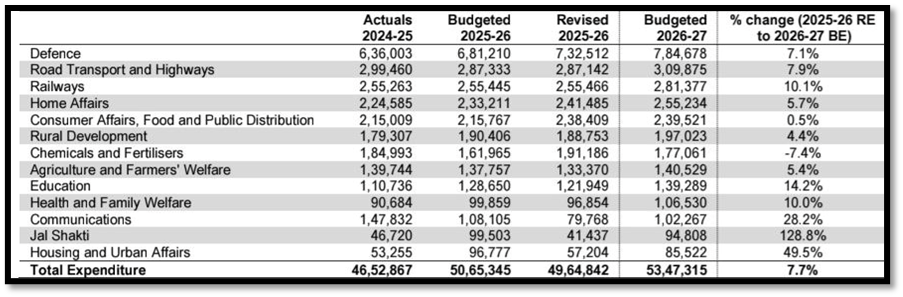

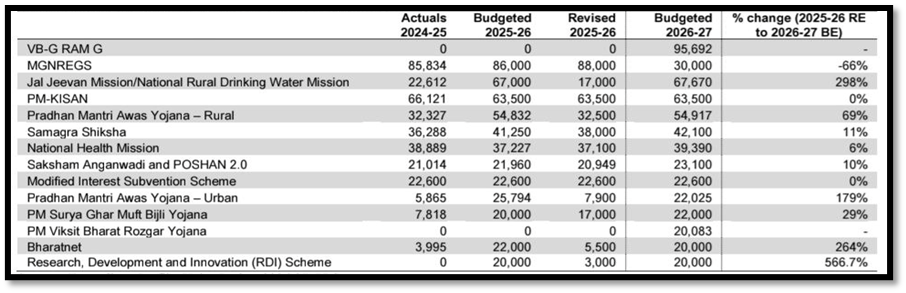

UNION BUDGET 2026-27 OTHER INFOGRAPHICS:

Budget at a Glance (2026-27):

Ministry – wise Expenditure (2026-27):

Scheme – wise allocation (2026 -27):

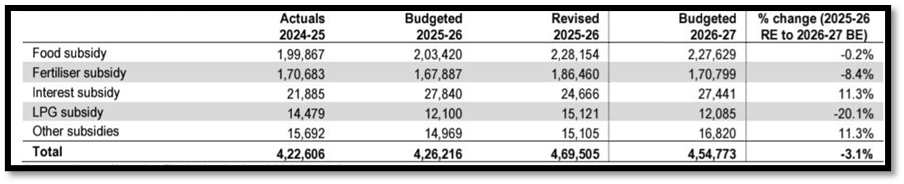

Subsidies in (2026 -27):

Source: (The Indian Express, The Hindu, Live Mint)

La Excellence IAS Academy, the best IAS coaching in Hyderabad, known for delivering quality content and conceptual clarity for UPSC 2026 preparation.

FOLLOW US ON:

◉ YouTube : https://www.youtube.com/@CivilsPrepTeam

◉ Facebook: https://www.facebook.com/LaExcellenceIAS

◉ Instagram: https://www.instagram.com/laexcellenceiasacademy/

GET IN TOUCH:

Contact us at info@laex.in, https://laex.in/contact-us/

or Call us @ +91 9052 29 2929, +91 9052 99 2929, +91 9154 24 2140

OUR BRANCHES:

Head Office: H No: 1-10-225A, Beside AEVA Fertility Center, Ashok Nagar Extension, VV Giri Nagar, Ashok Nagar, Hyderabad, 500020

Madhapur: Flat no: 301, survey no 58-60, Guttala begumpet Madhapur metro pillar: 1524, Rangareddy Hyderabad, Telangana 500081

Bangalore: Plot No: 99, 2nd floor, 80 Feet Road, Beside Poorvika Mobiles, Chandra Layout, Attiguppe, Near Vijaya Nagara, Bengaluru, 560040