Paper: GS – III, Subject: Economy, Topic: Taxation, Issue: 16th Finance Commission Report.

Context:

The 16th Finance Commission, chaired by Dr. Arvind Panagariya, submitted its report for the fiscal period of 2026-31. The Central government has accepted its recommendations regarding the devolution of funds from the Centre to the States, marking a critical moment in India’s fiscal federalism.

Key Takeaways:

Past Recommendations and Tax Sharing:

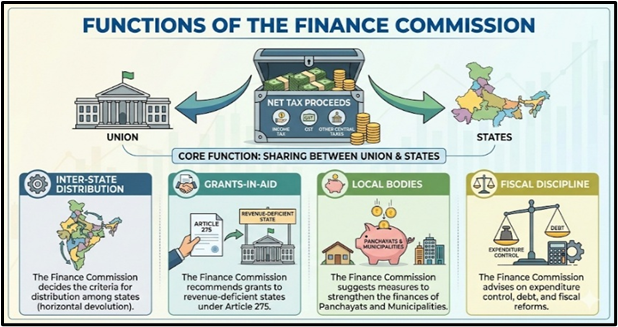

According to Article 270 of the Indian Constitution, the distribution of net tax proceeds collected by the Central government between the Centre and the States is mandated.

The taxes shared include:

- Corporation Tax

- Personal Income Tax

- Central Goods and Services Tax (GST)

- Centre’s share of the Integrated Goods and Services Tax (IGST)

It is important to note that cess and surcharge levied by the Centre are excluded from this divisible pool.

- For the fiscal year 2025-26, it is estimated that the divisible pool constitutes approximately 81% of the gross tax revenue of the Centre after excluding cess and surcharge.

| Finance Commission: The Finance Commission is a constitutional commission under Article 280 that ensures fiscal federalism in India. Constitution: The Finance Commission is constituted by the President of India every five years. Composition: One ChairmanFour Members with expertise in finance, economics, or public administration. Advisory Role: The Finance Commission examines financial matters referred by the President. Significance: The Finance Commission is the key commission ensuring equitable resource distribution and cooperative federalism in India. |

Vertical Devolution:

- Retained States’ share in central taxes at 41%.

- No cap on cess and surcharge; not included in the divisible pool as they help the Union meet urgent resource needs.

- Reasons for maintaining 41%:

- States already receive a significant share of total tax revenues.

- A large portion of Union spending through Centrally Sponsored Schemes (CSS) ultimately reaches States.

- The Centre needs higher funds for defense and infrastructure.

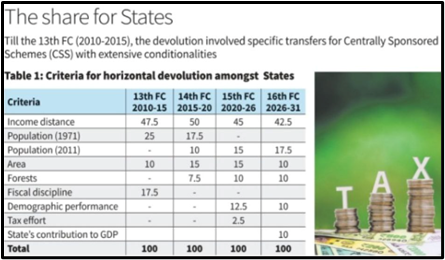

Horizontal Devolution:

- Guided by two key principles:

- Changes in States’ shares should be gradual, avoiding sudden disruptions.

- Efficiency and growth contribution of States should be recognized.

The 16th Finance Commission keeps vertical devolution at 41% while adding GDP contribution as a horizontal criterion, balancing state demands and central constraints, and highlighting the importance of Centre–State dialogue in strengthening fiscal federalism.

Source: (The Hindu)

La Excellence IAS Academy, the best IAS coaching in Hyderabad, known for delivering quality content and conceptual clarity for UPSC 2026 preparation.

FOLLOW US ON:

◉ YouTube : https://www.youtube.com/@CivilsPrepTeam

◉ Facebook: https://www.facebook.com/LaExcellenceIAS

◉ Instagram: https://www.instagram.com/laexcellenceiasacademy/

GET IN TOUCH:

Contact us at info@laex.in, https://laex.in/contact-us/

or Call us @ +91 9052 29 2929, +91 9052 99 2929, +91 9154 24 2140

OUR BRANCHES:

Head Office: H No: 1-10-225A, Beside AEVA Fertility Center, Ashok Nagar Extension, VV Giri Nagar, Ashok Nagar, Hyderabad, 500020

Madhapur: Flat no: 301, survey no 58-60, Guttala begumpet Madhapur metro pillar: 1524, Rangareddy Hyderabad, Telangana 500081

Bangalore: Plot No: 99, 2nd floor, 80 Feet Road, Beside Poorvika Mobiles, Chandra Layout, Attiguppe, Near Vijaya Nagara, Bengaluru, 560040