Syllabus: GS-III

Subject: Economic Development

Context: Overseas investors net bought government bonds worth ₹35,000 crore in October-December

Synopsis:

- Foreign investment in Indian government bonds surged to a six-year high, reaching ₹35,000 crore in October-December 2023, propelled by JPMorgan’s decision to include Indian debt in its indexes.

- The full-year tally stands at ₹59,800 crore, the highest since 2017.

- Analysts anticipate continued inflows into the New Year, citing positive outlooks on India’s economic factors, including contained inflation and controlled fiscal risks.

- JPMorgan’s move is expected to bring additional inflows of about $25 billion into Indian bonds.

- The current 10-year benchmark bond yield is at 7.20%, with potential to dip below 7% due to factors like expected rate cuts from the Federal Reserve and a favorable economic environment.

What is Bond yield?

A bond yield is essentially the return on investment you get from holding a bond. It’s expressed as a percentage and reflects the total amount of money you’ll make from the bond’s interest payments and its eventual face value, all relative to the price you paid for it.

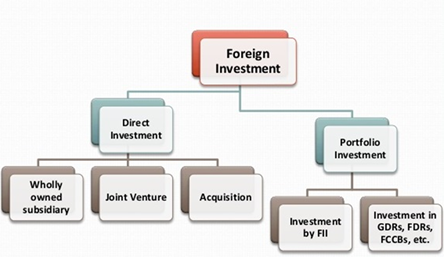

Foreign Investments:

Conclusion:

Positive economic outlook, expected rate cuts, and potential for the 10-year yield to dip below 7% signal an optimistic investment landscape.