Paper: GS-III, Subject: Economy, Topic: Taxation, Issue: Reforms needed in GST.

Context:

GST (2017) subsumed multiple indirect taxes into one unified system. PM during 79th Independence Day (2025) announced a structural rework of GST aimed at simplification, rationalization, and supporting Atmanirbhar Bharat.

Key Features of GST 2.0

1. Rate Rationalization

- Move towards a simplified two-rate structure:

- One standard rate.

- One merit rate (with limited exceptions).

- Benefits: reduces complexity, improves compliance, strengthens system integrity.

2. Focus on Essential Goods

- Tax cuts on essential goods providing relief to common man, farmers, MSMEs.

- Enhances affordability, boosts consumption and demand.

3. Simplification & Compliance

- Greater ease for small businesses and startups.

- Technology-driven measures aiming at:

- Seamless registration.

- Unified filing.

- Automated assessments.

- Faster refunds for exporters and sectors under stress.

4. Dispute Resolution

- Alternative mechanisms to reduce litigation.

- Faster, consensus-based dispute resolution.

5. Transparency & Fairness

- Eliminates distortions related to inverted duty structures.

- Ensures fairer tax framework across sectors.

- Promotes domestic value addition, competitiveness, and ‘Make in India’.

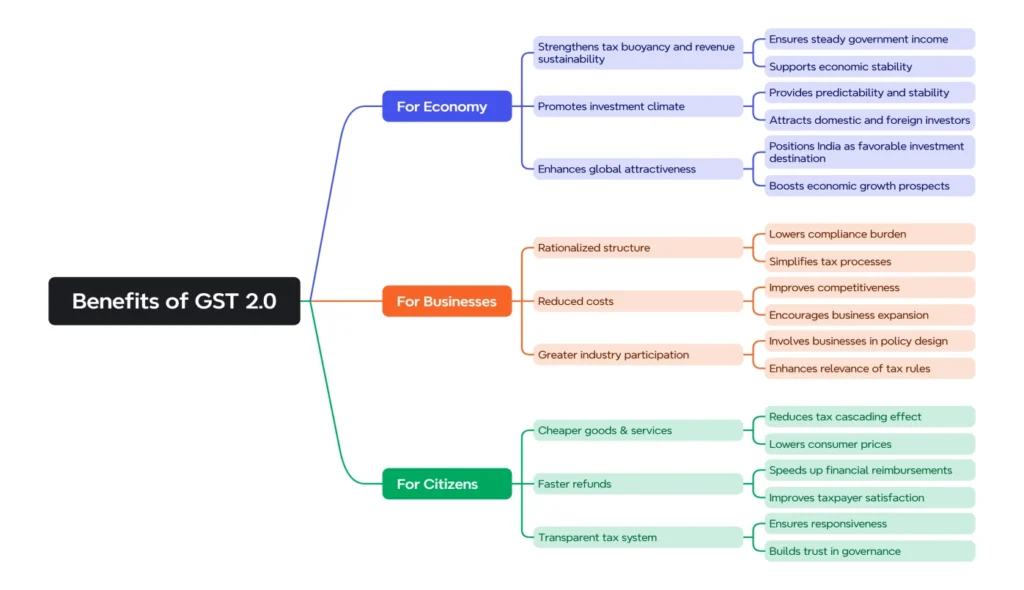

Benefits of GST 2.0

Challenges in Implementation

- Success depends on effective Centre–State coordination through GST Council.

- Need for sector-specific solutions such as for MSMEs, exporters.

- Must balance rate rationalization with revenue sustainability.

Way Forward

- Ensure broad-based stakeholder participation in decision-making.

- Enhance digital infrastructure for compliance and monitoring.

- Promote industry–government collaboration to refine tax policies.

- Gradually align GST with global best practices while retaining India’s needs.

Conclusion: GST 2.0 promises to deliver a simpler, fairer, and more competitive tax system. If implemented effectively, it can strengthen revenue, reduce costs, and boost both industry and household welfare, paving the way for India’s growth as a global economic powerhouse.

La Excellence IAS Academy, the best IAS coaching in Hyderabad, known for delivering quality content and conceptual clarity for UPSC 2025 preparation.

FOLLOW US ON:

◉ YouTube : https://www.youtube.com/@CivilsPrepTeam

◉ Facebook: https://www.facebook.com/LaExcellenceIAS

◉ Instagram: https://www.instagram.com/laexcellenceiasacademy/

GET IN TOUCH:

Contact us at info@laex.in, https://laex.in/contact-us/

or Call us @ +91 9052 29 2929, +91 9052 99 2929, +91 9154 24 2140

OUR BRANCHES:

Head Office: H No: 1-10-225A, Beside AEVA Fertility Center, Ashok Nagar Extension, VV Giri Nagar, Ashok Nagar, Hyderabad, 500020

Madhapur: Flat no: 301, survey no 58-60, Guttala begumpet Madhapur metro pillar: 1524, Rangareddy Hyderabad, Telangana 500081

Bangalore: Plot No: 99, 2nd floor, 80 Feet Road, Beside Poorvika Mobiles, Chandra Layout, Attiguppe, Near Vijaya Nagara, Bengaluru, 560040