Paper: GS – III, Subject: Environment and Ecology and Disaster Management, Topic: Disaster Management, Issue: Rebuilding Fiscal Federalism in Disaster Response.

Context:

India’s disaster-financing system is increasingly centralised, underfunding States and causing delays.

Key Highlights:

The Widening Gap in Disaster Response:

The Wayanad Tragedy: Wayanad landslides (2024) exposed major gaps in disaster financing.

- Centre approved only ~11% of Kerala’s requested relief funds, revealing a severe mismatch between needs and allocations.

- India’s current disaster-financing system is struggling to meet increasing demands and requires structural reform.

The Disaster-Response Financing Framework:

Two-Tier Structure: India’s disaster-response financing framework, established under the Disaster Management Act, 2005, consists of two funds:

- State Disaster Response Fund (SDRF): Financed jointly by the Centre and States (75:25 ratio, 90:10 for Himalayan and north-eastern States), providing immediate relief.

- National Disaster Response Fund (NDRF): Fully funded by the Union government, supplementing the SDRF when a calamity is classified as severe.

Drift Towards Central Control:

Outdated and Rigid Relief Norms: Compensation ceilings for loss of life and property damage have remained stagnant for a decade, failing to meet actual reconstruction costs.

- Ambiguity in Classification: The Act lacks a clear definition of a ‘severe disaster,’ granting the Union government significant discretion in deciding eligibility for NDRF aid.

- Procedural Delays: Aid releases are subject to sequential clearances, including State memorandum, central assessment, and high-level approval, causing delays when urgency is paramount.

- Weak Allocation Criteria: The Finance Commission’s allocation criteria, based on population and geographical area, fail to accurately reflect actual hazard patterns and disaster vulnerability.

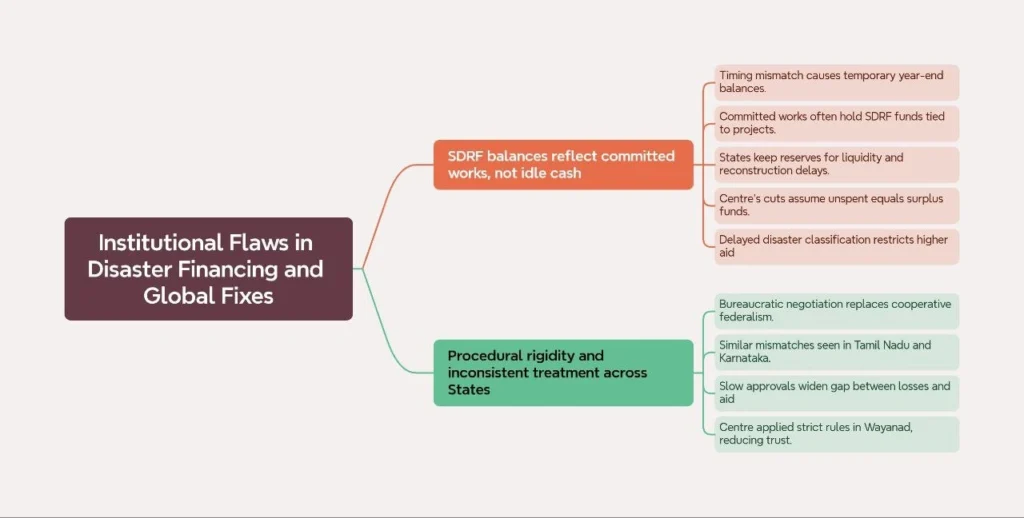

Institutional Flaws in Disaster Financing and Global Fixes:

Global objective-trigger models and lessons for India:

- Examples include FEMA, FONDEN, Philippines indices.

- Insurance facilities use satellite data for rapid payouts

- Possible triggers: rainfall intensity, fatalities per million.

- Loss-to-GSDP ratio or per-capita damage thresholds applicable.

Rebuilding the Federal Spirit:

- Opportunity for Reform: The Sixteenth Finance Commission has an opportunity to reframe this architecture.

- Update Relief Norms: Reflect current costs.

- Revise Allocation Criteria: Use a comprehensive vulnerability index.

- Grant-Based Assistance: Ensure that disaster assistance remains grant-based rather than debt-based.

India’s disaster-financing system must evolve from procedural charity to a rules-based partnership. The next flood or landslide should not leave States pleading for what the Constitution already guarantees a cooperative, equitable, and timely response

La Excellence IAS Academy, the best IAS coaching in Hyderabad, known for delivering quality content and conceptual clarity for UPSC 2025 preparation.

FOLLOW US ON:

◉ YouTube : https://www.youtube.com/@CivilsPrepTeam

◉ Facebook: https://www.facebook.com/LaExcellenceIAS

◉ Instagram: https://www.instagram.com/laexcellenceiasacademy/

GET IN TOUCH:

Contact us at info@laex.in, https://laex.in/contact-us/

or Call us @ +91 9052 29 2929, +91 9052 99 2929, +91 9154 24 2140

OUR BRANCHES:

Head Office: H No: 1-10-225A, Beside AEVA Fertility Center, Ashok Nagar Extension, VV Giri Nagar, Ashok Nagar, Hyderabad, 500020

Madhapur: Flat no: 301, survey no 58-60, Guttala begumpet Madhapur metro pillar: 1524, Rangareddy Hyderabad, Telangana 500081

Bangalore: Plot No: 99, 2nd floor, 80 Feet Road, Beside Poorvika Mobiles, Chandra Layout, Attiguppe, Near Vijaya Nagara, Bengaluru, 560040