Paper: GS – III, Subject: Economy, Topic: Growth and development, Issue: India’s GDP scenario.

Context:

2024–25 GDP Growth: NSO projects GDP growth at 6.5%, with Q4 growth at 7.4% compared to earlier advance estimates which were 6.4% and 6.5%.

Key Highlights:

Revised Growth Estimates for 2023–24:

- Initial Estimate: 7.3% growth.

- Revised Estimate: Increased to 8.2%, then to 9.2%.

- Improved Methodology: India’s GDP reporting now uses more reliable and updated data.

- Next Full Estimate: For 2024–25, will be released in early 2026.

- Long-Term Trend: Decadal average (including COVID period) was 6.6%.

Real vs Nominal GDP:

- Nominal GDP (includes inflation): Grew 9.8% in 2024–25.

- Absolute Increase: Nominal GDP rose to $3.91 trillion from $3.6 trillion in 2023–24.

Domestic Demand & Private Consumption:

- Growth in Private Consumption: 7.2% increase, including rural and urban demand.

- Sectoral trends: Higher spending on services, muted increase in goods.

- Investment Trends: Gross fixed capital formation grew 9.3%, driven largely by government and infrastructure capex.

Global Headwinds and Buffers:

- Insulation Limits: India’s domestic focus and capital flows cannot fully shield from global shocks.

- External Risks: Rising US tariffs and reduced competitiveness are key risks. US growth to fall to 1.5% in 2025 (from 2.8% in 2024), which will affect Indian exports.

- Global slowdown: Impact also expected from slower EU and China demand which may pose obstacles to India’s growth.

- US-China Trade Tensions: Ongoing tariff escalation will affect global supply chains. Indian exports to the US may face indirect consequences.

India’s advantages:

- FDI & Industry Shift: India benefits from global manufacturing shifts (e.g., Apple manufacturing in India).

- Global competition: With Vietnam & Mexico Competition, India needs structural reforms to remain competitive.

- India as Investment Destination:

- Macroeconomic stability.

- Moderate inflation.

- Low external debt.

- High forex reserves (~$586 billion).

- Moderate Inflation and Interest Rates: Monetary Policy Outlook: RBI may cut repo rates by 25 basis points though further moderation depends on global oil and food prices.

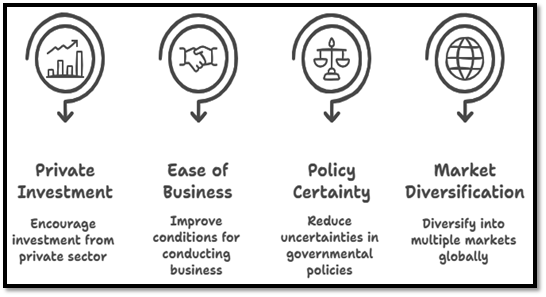

Way ahead:

La Excellence IAS Academy, the best IAS coaching in Hyderabad, known for delivering quality content and conceptual clarity for UPSC 2025 preparation.

FOLLOW US ON:

◉ Youtube : https://www.youtube.com/@CivilsPrepTeam

◉ Facebook: https://www.facebook.com/LaExcellenceIAS

◉ Instagram: https://www.instagram.com/laexcellenceiasacademy/

GET IN TOUCH:

Contact us at info@laex.in, https://laex.in/contact-us/

or Call us @ +91 9052 29 2929, +91 9052 99 2929, +91 9154 24 2140

OUR BRANCHES:

Head Office: H No: 1-10-225A, Beside AEVA Fertility Center, Ashok Nagar Extension, VV Giri Nagar, Ashok Nagar, Hyderabad, 500020

Madhapur: Flat no: 301, survey no 58-60, Guttala begumpet Madhapur metro pillar : 1524, Rangareddy Hyderabad, Telangana 500081

Bangalore: Plot No: 99, 2nd floor, 80 Feet Road, Beside Poorvika Mobiles, Chandra Layout, Attiguppe, Near Vijaya Nagara, Bengaluru, 560040