Paper: GS – III, Subject: Economy, Topic: Taxation, Issue: GST 2.0 for cooperative federalism.

Context:

56th GST Council meeting announced the launch of GST 2.0. The upcoming reforms should enable greater revenue share for states (60:40 split) to strengthen cooperative federalism.

Key Highlights:

Key GST Reforms:

- Tax Slab Rationalisation:

- Earlier: 4 slabs (5%, 12%, 18%, 28%).

- New system: 2 slabs retained (5% and 18%).

- 12% & 28% categories collapsed and moved to 5% or 18%.

- New penal slab for luxury & sin goods (tobacco, etc.).

- Impact on Revenue:

- 18% slab now collects majority of GST.

- Govt estimate of revenue loss: ₹1.5 trillion (gross) amounting to the net loss of ₹48,000 crore (FY 2023–24 base).

- Loss offset: Higher consumption spending and increased tax mop-up may offset losses.

- Expected Multiplier Effect:

- Fiscal multiplier of GST rate cut = 1.1.

- Reduction in tax burden leads to higher demand which results in more spending and higher tax revenue.

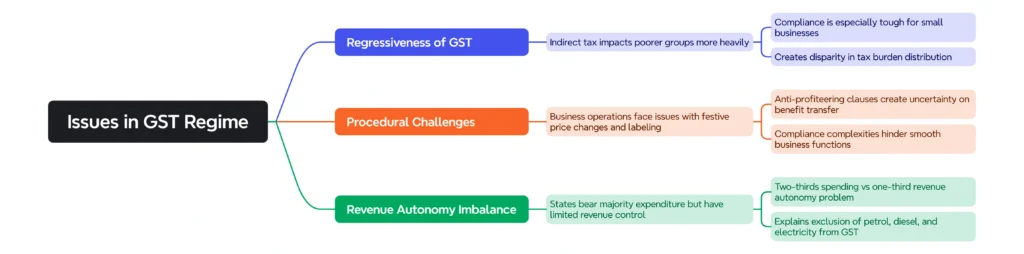

Issues in GST Regime:

Rationale for 60:40 Split in Favour of States:

- Larger fiscal burden borne by states especially in sectors such as health, education, and welfare.

- Strengthens cooperative federalism.

- Addresses mismatch between responsibility and revenue autonomy.

- Reduces state-level fiscal anxiety & dependence on central transfers.

Broader Implications:

| Positive | Challenges |

| Improves fiscal autonomy of states.Builds trust in federal relations.Encourages spending-led growth at state level | Centre may resist due to its own fiscal needs.Need for safeguards against states’ fiscal mismanagement. |

Way Forward:

- Implement 60:40 GST revenue sharing in phased manner.

- Ensure compliance simplification for businesses.

- Broaden GST base by including fuels, and electricity.

- Strengthen cooperative federalism by aligning fiscal capacity with responsibilities.

Conclusion:

GST 2.0 reforms mark a historic shift. A 60:40 split in favour of states is justified by their fiscal burden. Such reform will strengthen India’s federal structure and ensure fiscal stability with growth.

La Excellence IAS Academy, the best IAS coaching in Hyderabad, known for delivering quality content and conceptual clarity for UPSC 2025 preparation.

FOLLOW US ON:

◉ YouTube : https://www.youtube.com/@CivilsPrepTeam

◉ Facebook: https://www.facebook.com/LaExcellenceIAS

◉ Instagram: https://www.instagram.com/laexcellenceiasacademy/

GET IN TOUCH:

Contact us at info@laex.in, https://laex.in/contact-us/

or Call us @ +91 9052 29 2929, +91 9052 99 2929, +91 9154 24 2140

OUR BRANCHES:

Head Office: H No: 1-10-225A, Beside AEVA Fertility Center, Ashok Nagar Extension, VV Giri Nagar, Ashok Nagar, Hyderabad, 500020

Madhapur: Flat no: 301, survey no 58-60, Guttala begumpet Madhapur metro pillar: 1524, Rangareddy Hyderabad, Telangana 500081

Bangalore: Plot No: 99, 2nd floor, 80 Feet Road, Beside Poorvika Mobiles, Chandra Layout, Attiguppe, Near Vijaya Nagara, Bengaluru, 560040