Paper: GS – II, Subject: Polity, Topic: Institutions, Issue: Devolution of Finances to States.

Context:

India’s fiscal framework seeks balance through tax devolution and grants, but states increasingly worry that their fiscal space has been shrinking due to reduced transfers and rising central cesses.

Key Highlights:

Trends in Transfers from Centre to States:

1. Components of Transfers:

- Transfers from the Centre to the states consist of:

- Tax devolution (determined by the FC)

- FC grants (determined by the FC)

- Non-FC grants (at the discretion of the central government)

2. Impact of the 14th Finance Commission:

- It increased the share of states in the divisible pool of central taxes from 32% to 42%.

- States’ share in central taxes relative to the combined revenue receipts of the Centre and the states increased from an average of 15% during the 13th FC period to 19.2% in the 14th FC period (an increase of 4.25 percentage points).

- The post-transfer share of states increased by 4.23%, from 63.85% to 68.08% of combined revenue receipts.

3. Changes during the 15th Finance Commission:

- There was a small fall in states’ total receipts (fiscal space) during the 15th FC period.

- States’ aggregate revenue receipts relative to combined revenue receipts fell from 68.08% in the 14th FC period to 67.39% in the 15th FC period (a reduction of nearly 0.70 percentage points).

- This was primarily due to a reduction in the share of tax devolution by 1.05 percentage points to 18.2% in the 15th FC period.

- The reduction in tax devolution was largely offset by an increase in the shares of both FC and non-FC grants.

- The share of states’ own revenue receipts also fell from 37.72% (14th FC) to 37.35% (15th FC), a reduction of 0.47 percentage points.

- The number of states was reduced to 28 for the 15th FC period.

- The share of non-sharable cesses and surcharges by the central government had been increased.

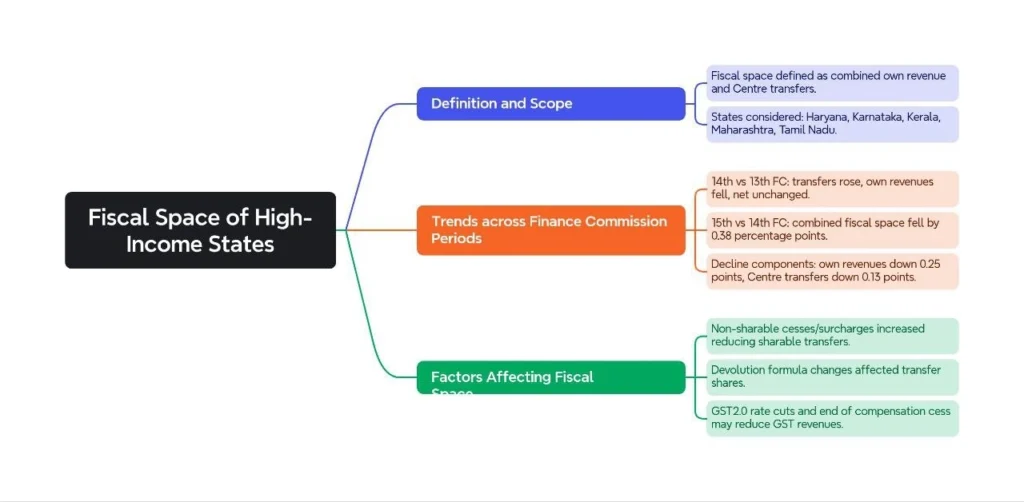

Fiscal Space of High-Income States:

Recommendations and Conclusion:

Considerations for the 16th Finance Commission:

- The 16th Finance Commission should take into account the concerns regarding the fiscal space available to the states, especially high-income states.

- The weight attached to the distance criterion in the horizontal distribution should be modified.

Role of the Central Government:

- The Centre should refrain from raising non-sharable surcharges and cesses.

Overall Fiscal Health:

- Both the Centre and the states need larger resources to meet multiple challenges.

- Tax receipts of both the Union and state governments must increase.

- A fair system of transfers that strikes a balance between equity and contribution is essential.

Way Forward:

- Ensure states’ fair share in the divisible pool.

- Limit excessive use of cesses and surcharges.

- Strengthen GST revenue flows and expand the tax base.

- Promote cooperative fiscal federalism to protect states’ long-term fiscal sustainability.

La Excellence IAS Academy, the best IAS coaching in Hyderabad, known for delivering quality content and conceptual clarity for UPSC 2025 preparation.

FOLLOW US ON:

◉ YouTube : https://www.youtube.com/@CivilsPrepTeam

◉ Facebook: https://www.facebook.com/LaExcellenceIAS

◉ Instagram: https://www.instagram.com/laexcellenceiasacademy/

GET IN TOUCH:

Contact us at info@laex.in, https://laex.in/contact-us/

or Call us @ +91 9052 29 2929, +91 9052 99 2929, +91 9154 24 2140

OUR BRANCHES:

Head Office: H No: 1-10-225A, Beside AEVA Fertility Center, Ashok Nagar Extension, VV Giri Nagar, Ashok Nagar, Hyderabad, 500020

Madhapur: Flat no: 301, survey no 58-60, Guttala begumpet Madhapur metro pillar: 1524, Rangareddy Hyderabad, Telangana 500081

Bangalore: Plot No: 99, 2nd floor, 80 Feet Road, Beside Poorvika Mobiles, Chandra Layout, Attiguppe, Near Vijaya Nagara, Bengaluru, 560040