Paper: GS – II, Subject: Polity, Topic: Legislature, Issue: Pan Masala Cess and Higher Excise duty on Tobacco Products.

Context:

Recently, the Health Security and National Security Cess Bill, 2025 and the Central Excise (Amendment) Bill, 2025 were introduced in Parliament by Union Finance Minister Nirmala Sitharaman.

Key Takeaways:

Key Highlights of the Bills:

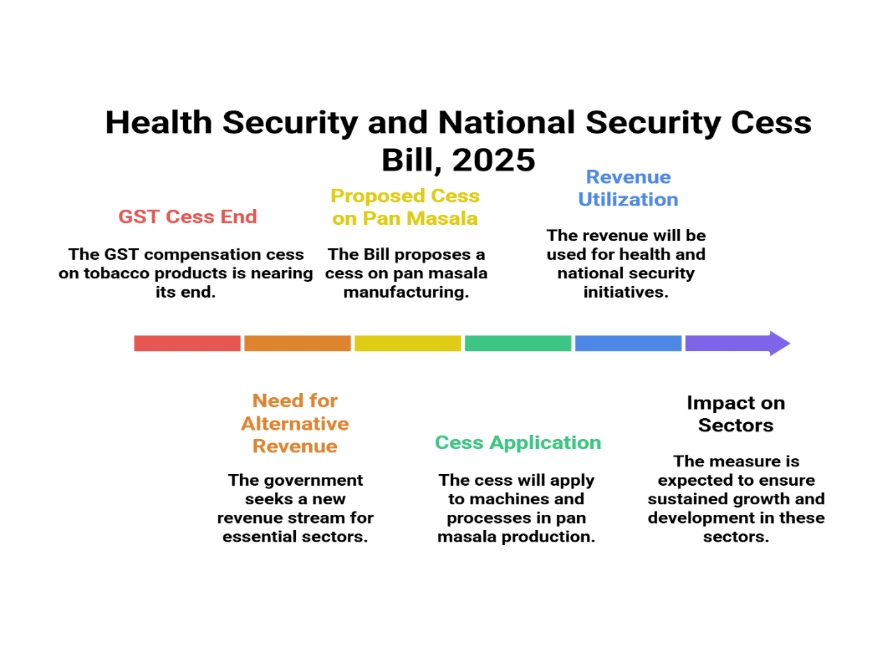

- Objective: The primary goal is to replace the revenue generated from the GST compensation cess on tobacco products, which is nearing its discontinuation.

- Two Bills:

- The Health Security and National Security Cess Bill, 2025: This bill proposes a cess on “machines installed, or other processes undertaken in the manufacture of pan masala.” The revenue generated will be used to augment funding for health and national security initiatives.

- The Central Excise (Amendment) Bill, 2025: This bill seeks to raise the excise duty on tobacco products.

| GST Compensation Cess Background: About GST Compensation Cess: It is levied under Section 8 of The Goods and Services Tax (Compensation to State) Act, 2017. Why is GST Cess Levied? As GST is a consumption-based tax, the state in which the consumption of goods and supply happen would be eligible for the indirect tax revenue. Hence, after GST comes into effect, some states that are net exporters of goods and/or services are expected to experience a decrease in indirect tax revenue.During the COVID-19 pandemic years (2020-21 and 2021-22), the cess collections fell short of the compensation requirements, leading the Centre to borrow funds to compensate the states.The compensation cess on tobacco products will be discontinued once the government repays the interest on these loans. |

These Bills aim to restructure taxation on pan masala and tobacco by replacing the GST compensation cess, ensuring revenue for health and security, discouraging tobacco use, and awaiting parliamentary debate.

La Excellence IAS Academy, the best IAS coaching in Hyderabad, known for delivering quality content and conceptual clarity for UPSC 2025 preparation.

FOLLOW US ON:

◉ YouTube : https://www.youtube.com/@CivilsPrepTeam

◉ Facebook: https://www.facebook.com/LaExcellenceIAS

◉ Instagram: https://www.instagram.com/laexcellenceiasacademy/

GET IN TOUCH:

Contact us at info@laex.in, https://laex.in/contact-us/

or Call us @ +91 9052 29 2929, +91 9052 99 2929, +91 9154 24 2140

OUR BRANCHES:

Head Office: H No: 1-10-225A, Beside AEVA Fertility Center, Ashok Nagar Extension, VV Giri Nagar, Ashok Nagar, Hyderabad, 500020

Madhapur: Flat no: 301, survey no 58-60, Guttala begumpet Madhapur metro pillar: 1524, Rangareddy Hyderabad, Telangana 500081

Bangalore: Plot No: 99, 2nd floor, 80 Feet Road, Beside Poorvika Mobiles, Chandra Layout, Attiguppe, Near Vijaya Nagara, Bengaluru, 560040