Paper: GS – II, Subject: Polity, Topic: Institutions, Issue: Comptroller and Auditor General (CAG).

Context:

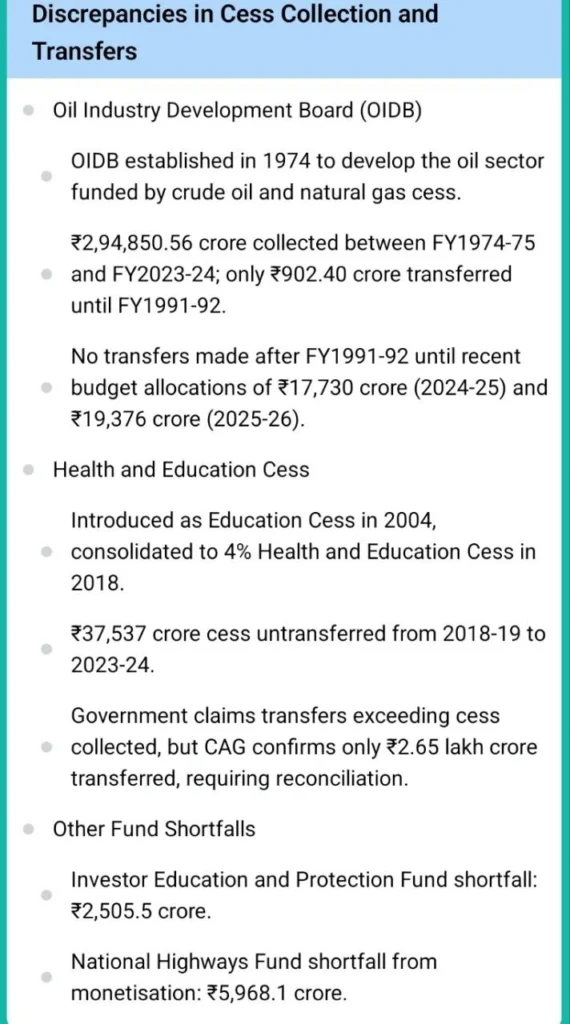

The Comptroller and Auditor General (CAG) report highlighting the central government’s failure to transfer ₹3.69 lakh crore in cess collections to designated funds as of 2023-24. The report identifies significant shortfalls in transfers to funds created for investor education and protection, monetization of national highways, development of the oil industry, and health and education.

Key Takeaways:

Key Findings of the CAG Report on Government Cess Transfers:

| Comptroller and Auditor General of India: The Constitution of India (Article 148) provides for an independent office of the Comptroller and Auditor General of India (CAG).He is the head of the Indian Audit and Accounts Department and is one of the bulwarks of the democratic system of government in IndiaHe is the guardian of the public purse and controls the entire financial system of the country at both the levels–the Centre and the state.His duty is to uphold the Constitution of India and laws of Parliament in the field of financial administration. Constitutional Provisions for Office of CAG: Article 148 broadly deals with the CAG appointment, oath and conditions of service.Article 149 deals with Duties and Powers of the Comptroller and Auditor-General of India.Article 150 says that the accounts of the Union and of the States shall be kept in such form as the President may, on the advice of the CAG, prescribe.Article 151says that the reports of the Comptroller and Auditor-General of India relating to the accounts of the Union shall be submitted to the president, who shall cause them to be laid before each House of Parliament. |

About Cesses and Surcharges:

- Cess and surcharges are levied by the Central government for the purposes of the Union under Article 271 of the Constitution of India.

- A cess is a tax on tax. The Indian government levies it on the tax liability, including surcharge, and it is used for a specific purpose.

- Cesses are named after the identified purpose; the purpose itself must be certain and for the public good.

- Some different types of cesses levied in India are infrastructure cess on motor vehicles, Krishi Kalyan cess on service value, Swachch Bharat cess, education cess, and cess on crude oil, among others.

- On the other hand, a surcharge is charged on the income taxes paid. It is usually paid by taxpayers, whether individuals, associations of persons, or companies, who fall in a particular tax bracket.

- Surcharge is not collected for any specific purpose but can be used for any reason as seen reasonable by the Central government.

- The proceeds collected from a surcharge and a cess levied by the union form part of the Consolidated Fund of India.

- The funds need not be shared with the State governments and are thus at the exclusive disposal of the union government.

- The proceeds of such surcharges and cesses go towards meeting certain specific needs, such as financing of centrally sponsored schemes.

- The benefit of such expenditure also percolates to the states.

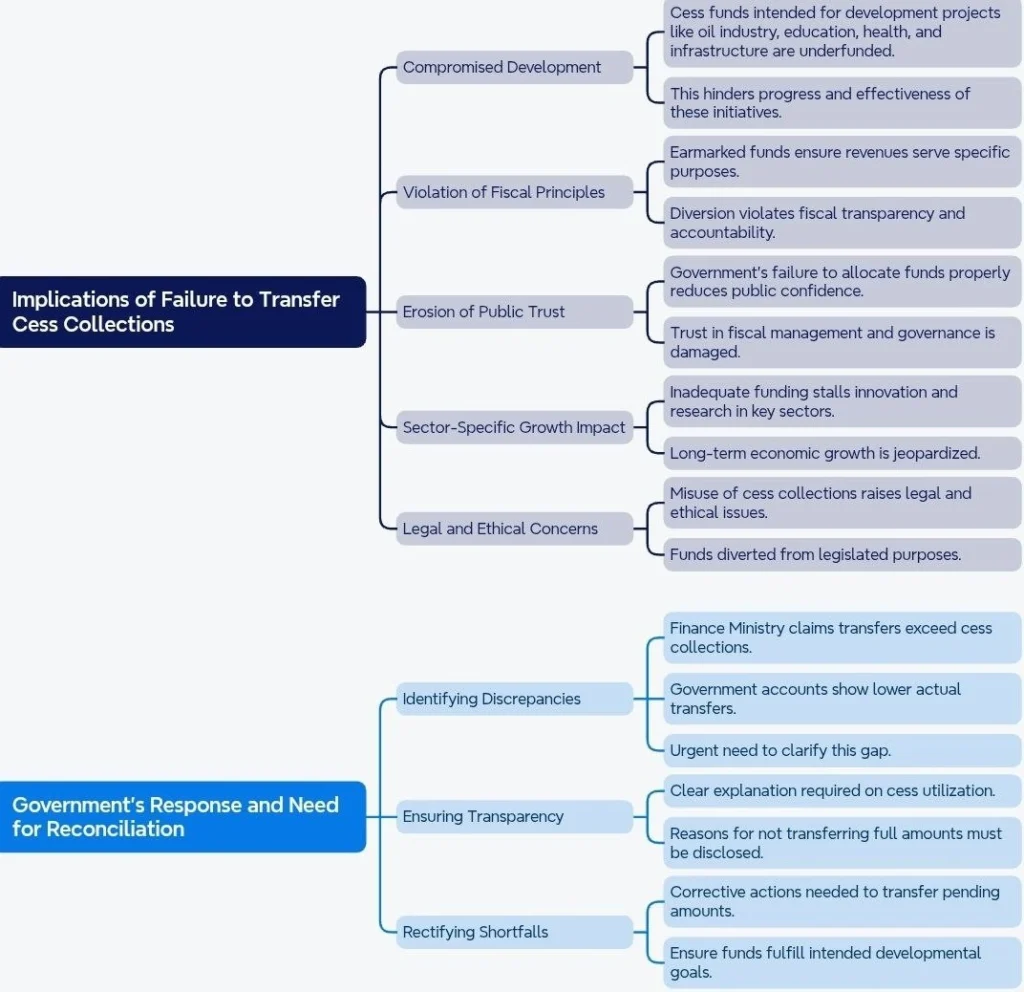

Implications of the Shortfalls in Cess Transfers:

Conclusion:

The significant shortfalls in transfers to critical development funds undermine the intended benefits of these levies and raise questions about fiscal governance. The government must address these discrepancies promptly, reconcile the accounts, and ensure that cess collections are utilized effectively for their intended purposes to promote sustainable development and maintain public trust.

La Excellence IAS Academy, the best IAS coaching in Hyderabad, known for delivering quality content and conceptual clarity for UPSC 2025 preparation.

FOLLOW US ON:

◉ YouTube : https://www.youtube.com/@CivilsPrepTeam

◉ Facebook: https://www.facebook.com/LaExcellenceIAS

◉ Instagram: https://www.instagram.com/laexcellenceiasacademy/

GET IN TOUCH:

Contact us at info@laex.in, https://laex.in/contact-us/

or Call us @ +91 9052 29 2929, +91 9052 99 2929, +91 9154 24 2140

OUR BRANCHES:

Head Office: H No: 1-10-225A, Beside AEVA Fertility Center, Ashok Nagar Extension, VV Giri Nagar, Ashok Nagar, Hyderabad, 500020

Madhapur: Flat no: 301, survey no 58-60, Guttala begumpet Madhapur metro pillar: 1524, Rangareddy Hyderabad, Telangana 500081

Bangalore: Plot No: 99, 2nd floor, 80 Feet Road, Beside Poorvika Mobiles, Chandra Layout, Attiguppe, Near Vijaya Nagara, Bengaluru, 560040