Paper: GS – III, Subject: Indian Economy, Topic: Economic Reforms, Issue: The Goods and Services Tax Reforms (GST Reforms) .

Context:

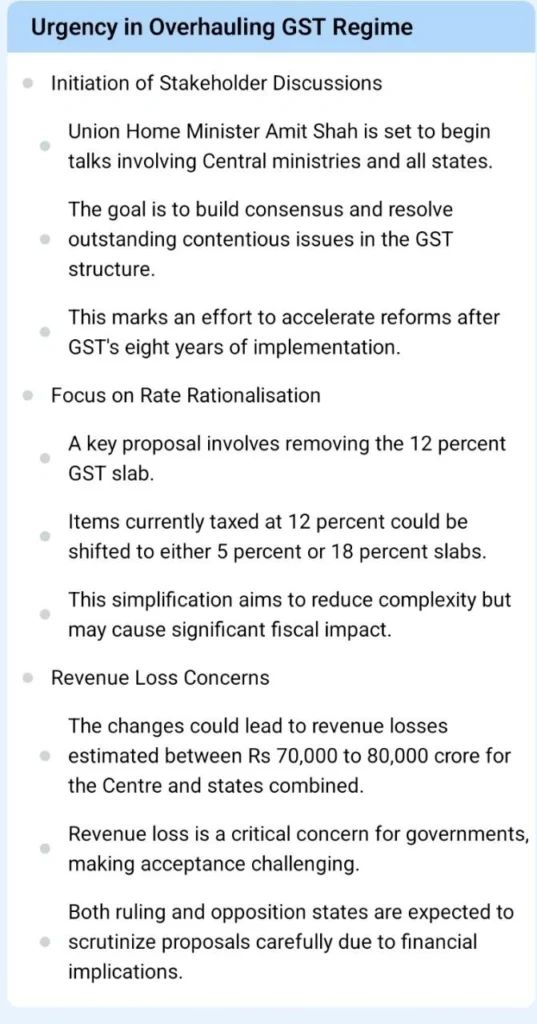

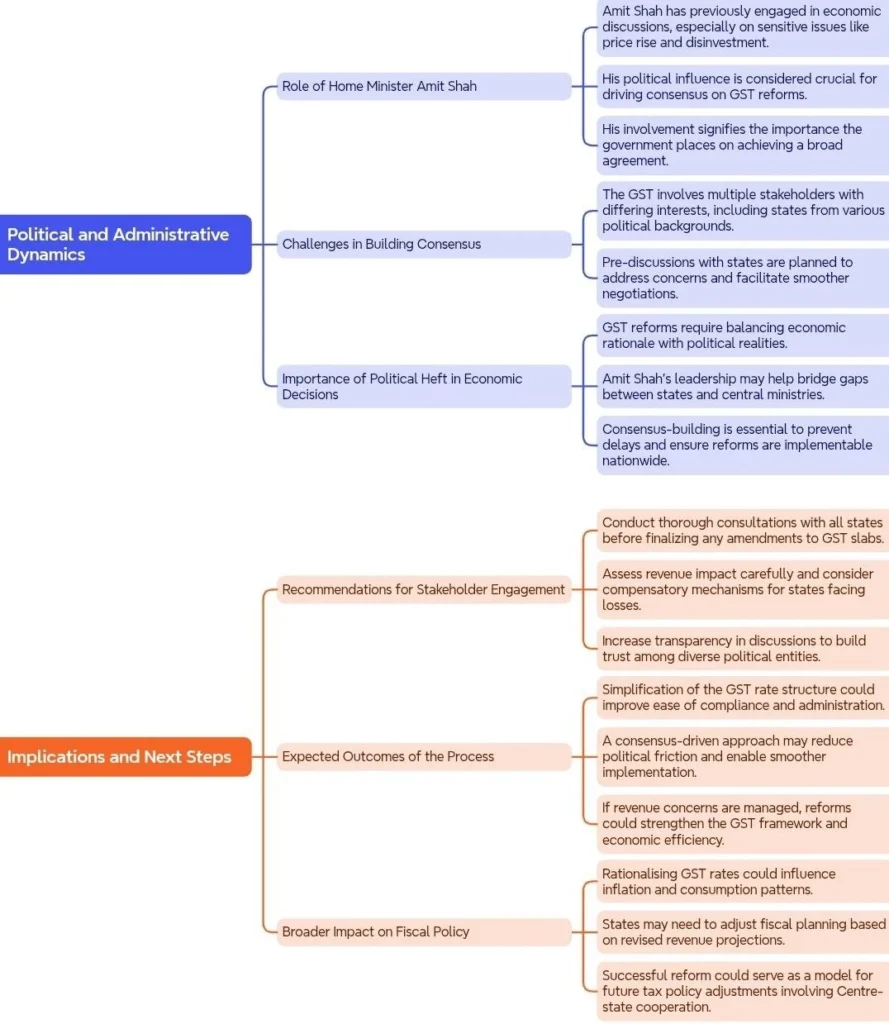

To push forward GST reforms, Union Home Minister Amit Shah will begin discussions with states and central ministries to build consensus on contentious issues, including the proposed removal of the 12% GST slab.

Key Takeaways:

| The Goods and Services Tax (GST): GST Council was established under the 101st Constitutional Amendment Act, 2016. The GST Council is a constitutional body responsible for addressing GST-related issues and providing recommendations to both the Union and State governments on matters of taxation. It also plays a crucial role in shaping the GST framework and ensuring its effective implementation across the country. The GST Council is a pivotal constitutional body tasked with overseeing the implementation and administration of the GST in India. Formed under the 101st Constitutional Amendment through Article 279A, the GST Council plays a critical role in creating a harmonized tax structure and fostering a unified national market for goods and services. |

Key Issues and Challenges in GST Rate Rationalisation:

The GST regime, after eight years of implementation, is undergoing a review to streamline its structure and address existing complexities.

- A primary focus of this review is the rationalisation of GST rates, with the proposal to eliminate the 12% slab being a major point of discussion.

- Proposal to Eliminate the 12% Slab

- The proposal involves merging the 12% GST slab with the existing 5% and 18% slabs.

- This would entail shifting some items currently taxed at 12% to the lower 5% slab and others to the higher 18% slab.

GST Reforms: Home Minister initiates talks for Rate Rationalisation Consensus:

Conclusion:

- The GST rate rationalisation process is a complex and challenging undertaking. It requires careful consideration of various factors, including revenue implications, economic impact, and administrative feasibility.

- Union Home Minister Amit Shah’s involvement in the process is expected to provide the necessary impetus for building consensus among all stakeholders and achieving a mutually agreeable solution that benefits both the Central government and the states.

La Excellence IAS Academy, the best IAS coaching in Hyderabad, known for delivering quality content and conceptual clarity for UPSC 2025 preparation.

FOLLOW US ON:

◉ YouTube : https://www.youtube.com/@CivilsPrepTeam

◉ Facebook: https://www.facebook.com/LaExcellenceIAS

◉ Instagram: https://www.instagram.com/laexcellenceiasacademy/

GET IN TOUCH:

Contact us at info@laex.in, https://laex.in/contact-us/

or Call us @ +91 9052 29 2929, +91 9052 99 2929, +91 9154 24 2140

OUR BRANCHES:

Head Office: H No: 1-10-225A, Beside AEVA Fertility Center, Ashok Nagar Extension, VV Giri Nagar, Ashok Nagar, Hyderabad, 500020

Madhapur: Flat no: 301, survey no 58-60, Guttala begumpet Madhapur metro pillar: 1524, Rangareddy Hyderabad, Telangana 500081

Bangalore: Plot No: 99, 2nd floor, 80 Feet Road, Beside Poorvika Mobiles, Chandra Layout, Attiguppe, Near Vijaya Nagara, Bengaluru, 560040