Paper: GS – III, Subject: Indian Economy, Topic: Banking and Financial Intermediaries, Issue: Catastrophe Bonds.

Context:

Catastrophe bonds (cat bonds) are an innovative financial instrument designed to help manage the risk associated with natural disasters.

Key Takeaways:

Understanding Catastrophe bonds (cat bonds):

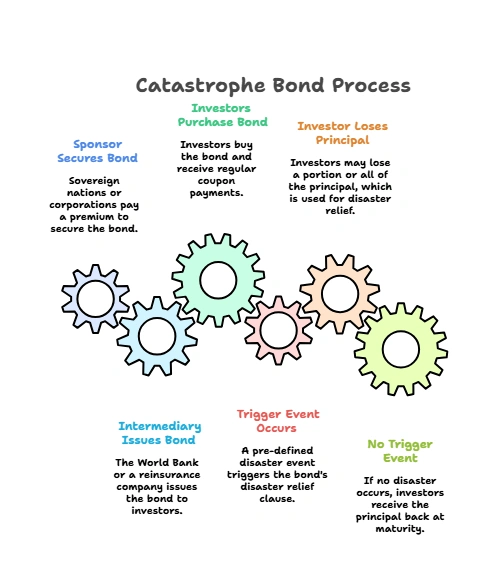

- Catastrophe bonds are hybrid financial instruments that combine features of insurance and debt.

- They allow at-risk entities, usually sovereign states, to transfer defined disaster risks to investors.

- In the event of a predefined natural disaster, investors lose a part or all of their principal, which is then used for post-disaster relief and reconstruction.

- If no disaster occurs during the bond’s tenure, investors receive their principal back along with a relatively high coupon (interest) rate.

- These bonds effectively turn a country’s hazard exposure into a tradable security, opening access to a wider pool of capital beyond traditional insurers and reinsurers.

- This reduces counterparty risk and enables faster payouts, essential in times of crisis.

Catastrophe Bonds: Stakeholders, Adoption, and Challenges:

La Excellence IAS Academy, the best IAS coaching in Hyderabad, known for delivering quality content and conceptual clarity for UPSC 2025 preparation.

FOLLOW US ON:

◉ YouTube : https://www.youtube.com/@CivilsPrepTeam

◉ Facebook: https://www.facebook.com/LaExcellenceIAS

◉ Instagram: https://www.instagram.com/laexcellenceiasacademy/

GET IN TOUCH:

Contact us at info@laex.in, https://laex.in/contact-us/

or Call us @ +91 9052 29 2929, +91 9052 99 2929, +91 9154 24 2140

OUR BRANCHES:

Head Office: H No: 1-10-225A, Beside AEVA Fertility Center, Ashok Nagar Extension, VV Giri Nagar, Ashok Nagar, Hyderabad, 500020

Madhapur: Flat no: 301, survey no 58-60, Guttala begumpet Madhapur metro pillar: 1524, Rangareddy Hyderabad, Telangana 500081

Bangalore: Plot No: 99, 2nd floor, 80 Feet Road, Beside Poorvika Mobiles, Chandra Layout, Attiguppe, Near Vijaya Nagara, Bengaluru, 560040