Paper: GS – III, Subject: Indian Economy, Topic: Government Policies, Issue: The Unified Pension Scheme (UPS).

Context:

The Unified Pension Scheme (UPS) was introduced in April 2025 as a middle path between the Old Pension Scheme (OPS) and the National Pension System (NPS).

- It was expected to address the discontent among employees demanding restoration of OPS, while maintaining fiscal prudence like the NPS.

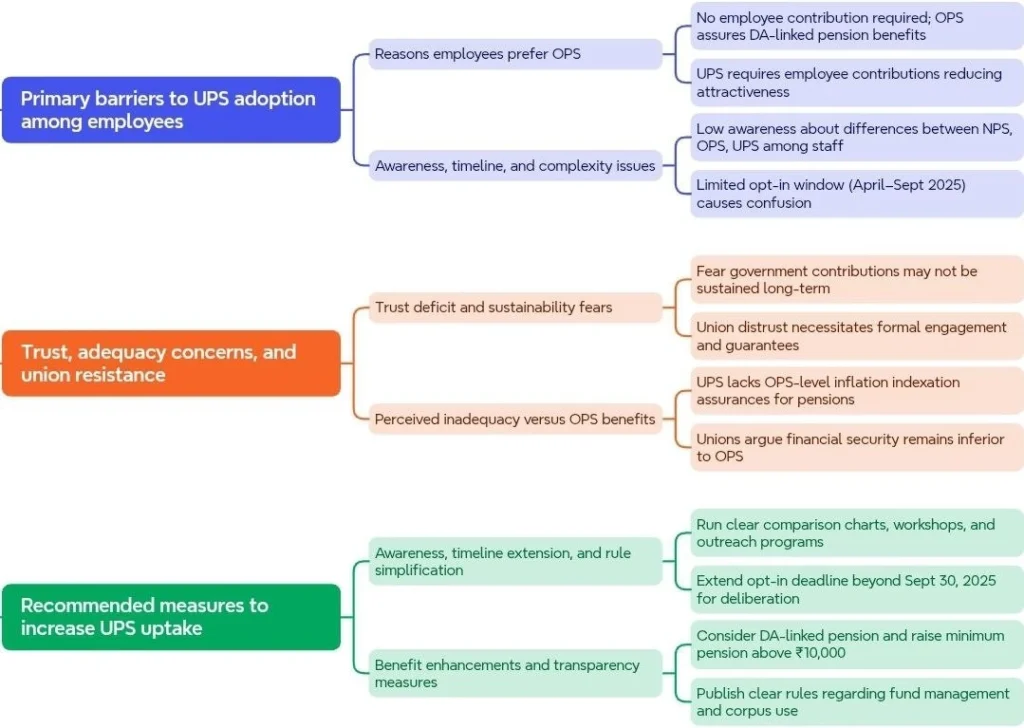

- However, despite its blend of assured pension and contributory features, the scheme has seen limited uptake, with only around 40,000 out of nearly 24 lakh central government employees opting for it so far.

- This lukewarm response reflects deeper issues of trust, awareness, and comparative benefits.

Key Takeaways:

What is the Unified Pension Scheme (UPS)?

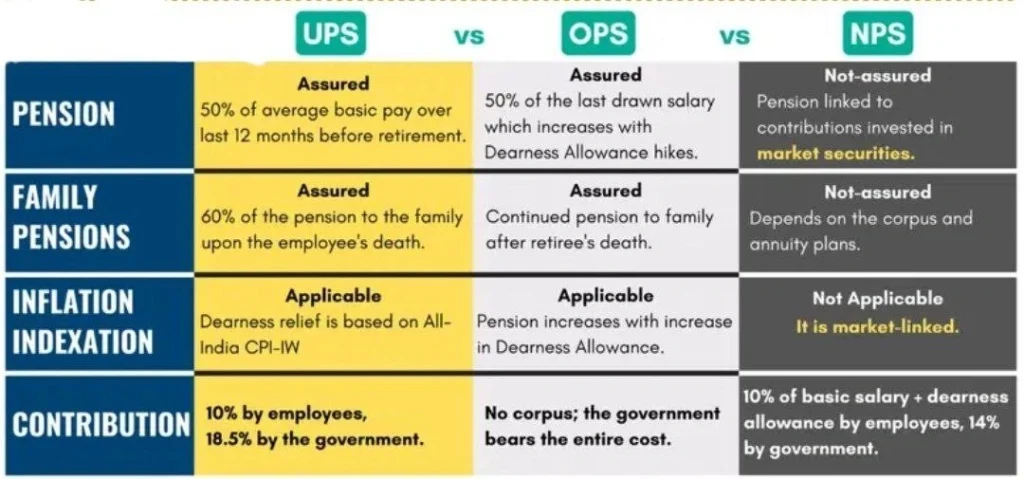

- The NDA government has introduced the Unified Pension Scheme (UPS), which closely resembles the Old Pension Scheme (OPS) and assures government employees a lifelong monthly benefit of 50% of their last drawn salary.

- The Unified Pension Scheme was based on T.V. Somanathan Committee recommendations for reviewing the National Pension System (NPS) to balance employee aspirations with fiscal responsibility.

- The scheme offers a choice for employees who joined after 2004 between the new scheme and the existing National Pension System (NPS).

- It will take effect from April 1, 2025. The State governments can adopt it as per their preference.

Old Pension Scheme (OPS):

- OPS pension to government employees at the Centre and States was fixed at 50% of their last drawn basic pay.

- In addition, a Dearness Relief was given to adjust to the increase in cost of living which was calculated as a percentage of the basic salary.

- However, it was unfunded as no corpus was specifically available for pension which led to the introduction of New Pension Scheme in 2004 by the NDA government.

New Pension Scheme (NPS):

- NPS replaced the OPS on January 1, 2004 as a part of Centre’s effort to reform pension policies in India as OPS could not run in long term as it imbalances fiscal expenditure.

- NPS contribution: 10% of the basic salary and dearness allowance by the employees and 14% by government (which is proposed to be increased to 18% under UPS).

- Schemes under NPS is offered by nine pension fund managers: LIC, SBI, ICICI, Tata, Aditya Birla, Kotak Mahindra, HDFC, UTI and Max.

Challenges and Measures for UPS Uptake:

Conclusion:

The UPS was designed as a compromise between the fiscal realities of the NPS and the assured safety net of OPS. But the lukewarm response reflects employees’ continuing preference for OPS, concerns about adequacy, and lack of awareness. To make UPS a credible alternative, government must focus on greater clarity, transparency, and inflation-adjusted benefits. Only then can UPS evolve into a reliable and acceptable pension system balancing employee welfare and fiscal discipline.

La Excellence IAS Academy, the best IAS coaching in Hyderabad, known for delivering quality content and conceptual clarity for UPSC 2025 preparation.

FOLLOW US ON:

◉ YouTube : https://www.youtube.com/@CivilsPrepTeam

◉ Facebook: https://www.facebook.com/LaExcellenceIAS

◉ Instagram: https://www.instagram.com/laexcellenceiasacademy/

GET IN TOUCH:

Contact us at info@laex.in, https://laex.in/contact-us/

or Call us @ +91 9052 29 2929, +91 9052 99 2929, +91 9154 24 2140

OUR BRANCHES:

Head Office: H No: 1-10-225A, Beside AEVA Fertility Center, Ashok Nagar Extension, VV Giri Nagar, Ashok Nagar, Hyderabad, 500020

Madhapur: Flat no: 301, survey no 58-60, Guttala begumpet Madhapur metro pillar: 1524, Rangareddy Hyderabad, Telangana 500081

Bangalore: Plot No: 99, 2nd floor, 80 Feet Road, Beside Poorvika Mobiles, Chandra Layout, Attiguppe, Near Vijaya Nagara, Bengaluru, 560040