Paper: GS – II, Subject: International Relations, Topic: India’s Foreign Policy, Issue: India – UK Relations.

Context:

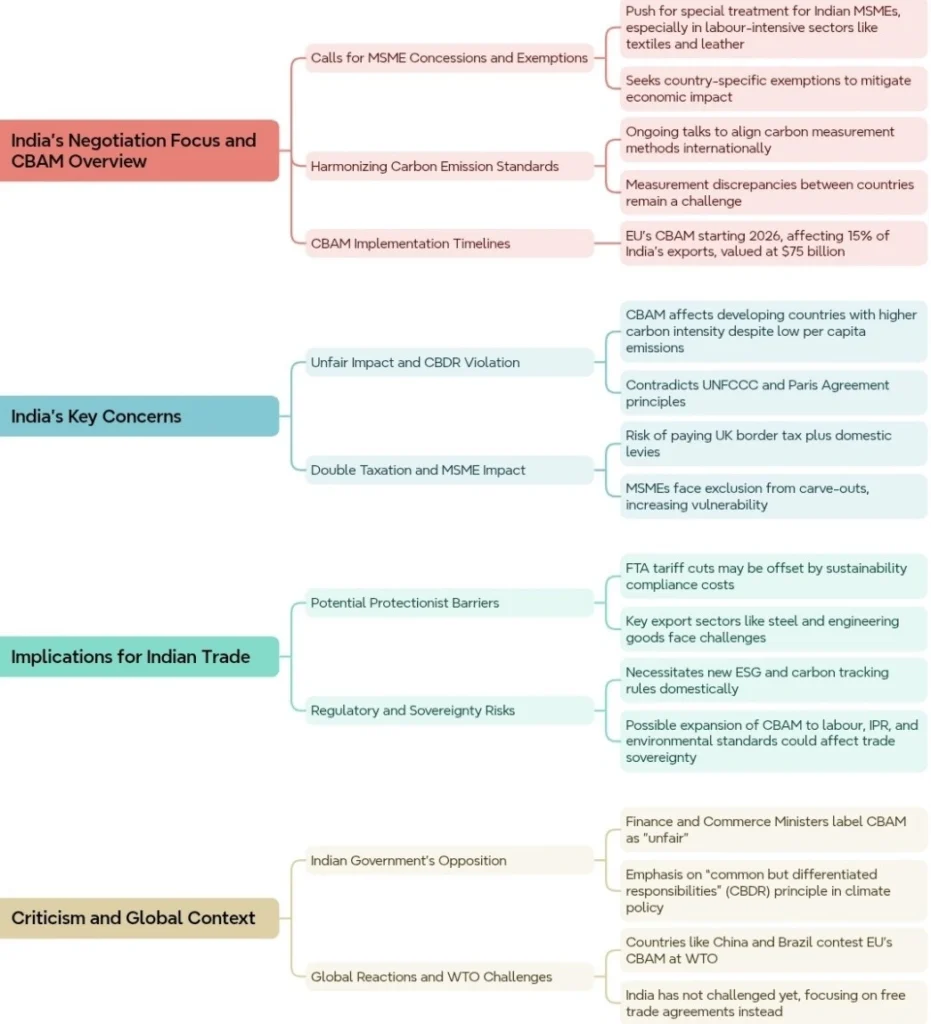

India has warned it will retaliate if the UK implements a carbon tax (CBAM) on Indian exports from January 2027, calling it a violation of the Common but Differentiated Responsibilities (CBDR) principle in global climate agreements.

Key Takeaways:

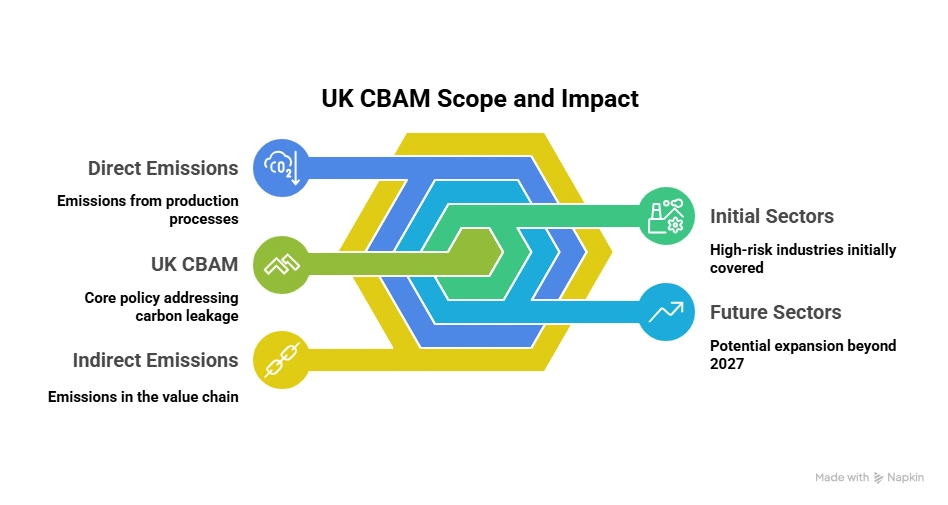

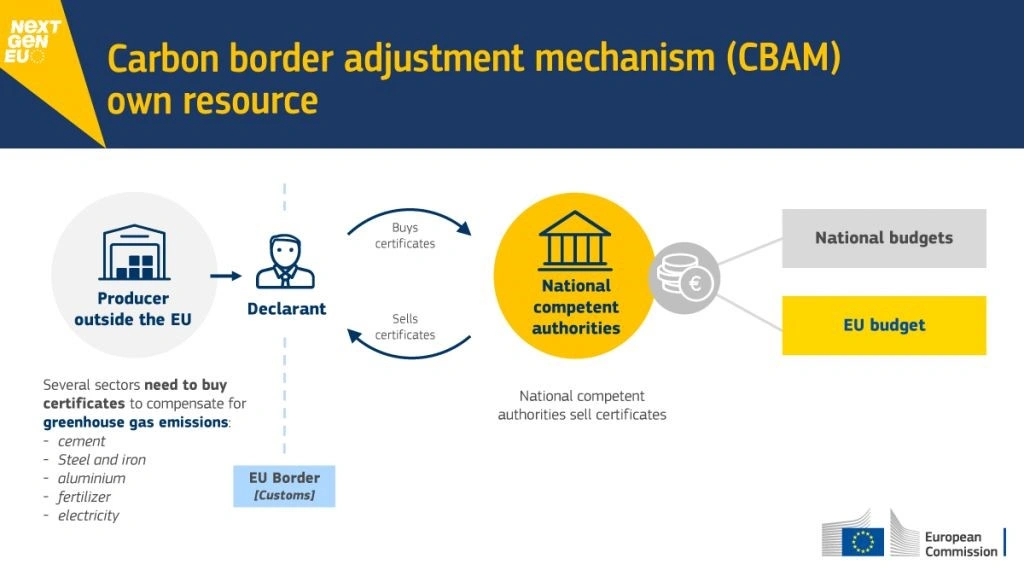

About CBAM (Carbon Border Adjustment Mechanism):

- It is a form of carbon tax on imports imposed by developed countries (like the EU or UK) based on the carbon intensity of production in the exporting country.

- Aims to prevent carbon leakage by equalizing carbon prices between domestic and imported goods.

- The UK’s version of CBAM is expected to start from January 1, 2027.

- Sectors like steel, aluminium, cement, and energy-intensive goods are likely to be affected first.

UK’s Carbon Border Adjustment Mechanism (CBAM):

- The UK is firm on not providing concessions under the CBAM, which imposes duties on carbon-intensive imports.

- India proposed a “rebalancing mechanism” to compensate for industry losses due to CBAM.

- This mechanism is included in the ‘general exceptions’ chapter, which helps avoid WTO disputes.

General Exceptions in Trade Agreements:

Under GATT, countries can implement measures that violate trade rules if justified by public health or environmental protection

India’s Negotiations points and CBAM Legislation:

India’s inability to secure concessions under the UK’s carbon tax may harm key exports, necessitating proactive measures, including WTO challenges and enhanced sustainability practices, to safeguard its trade interests and future growth.

https://indianexpress.com/article/business/india-uk-carbon-tax-trade-pact-10148660/

La Excellence IAS Academy, the best IAS coaching in Hyderabad, known for delivering quality content and conceptual clarity for UPSC 2025 preparation.

FOLLOW US ON:

◉ YouTube : https://www.youtube.com/@CivilsPrepTeam

◉ Facebook: https://www.facebook.com/LaExcellenceIAS

◉ Instagram: https://www.instagram.com/laexcellenceiasacademy/

GET IN TOUCH:

Contact us at info@laex.in, https://laex.in/contact-us/

or Call us @ +91 9052 29 2929, +91 9052 99 2929, +91 9154 24 2140

OUR BRANCHES:

Head Office: H No: 1-10-225A, Beside AEVA Fertility Center, Ashok Nagar Extension, VV Giri Nagar, Ashok Nagar, Hyderabad, 500020

Madhapur: Flat no: 301, survey no 58-60, Guttala begumpet Madhapur metro pillar: 1524, Rangareddy Hyderabad, Telangana 500081

Bangalore: Plot No: 99, 2nd floor, 80 Feet Road, Beside Poorvika Mobiles, Chandra Layout, Attiguppe, Near Vijaya Nagara, Bengaluru, 560040