Paper: GS – III, Subject: Economy, Topic: Taxation, Issue: Proposed reforms in the GST system.

Context:

The GST Council approved a simplified two-rate structure (5% and 18%) with a special 40% sin tax, reducing rates on essentials effective September 22.

Key Takeaways:

Genesis of GST:

- Origin: Based on Vijay Kelkar Task Force recommendations (2002).

- Launch: July 1, 2017 – It replaced excise duty, VAT, service tax, etc. with one unified indirect tax.

- Structure: Multi-tiered (5%, 12%, 18%, 28%) + special rates (0.25% on precious stones, 3% on jewellery).

- Achievements:

- Doubled indirect tax base to 1.52 crore businesses.

- Integrated a national market.

Issues with the current GST System:

- Too Many Tax Rates: Multiple slabs (0%, 0.25%, 1%, 3%, 5%, 12%, 18%, 28% + cesses) create complexity and misclassification disputes.

- Revenue Neutral Rate (RNR) Gap: Average GST rate has fallen to 12%, below the recommended RNR of 15–15.5% (Arvind Subramanian Committee), reducing revenue for Centre & States.

- Inverted Duty Structure: Higher GST on inputs than outputs (e.g., textiles) has led to accumulation of unutilised ITC (Input Tax Credit) aggravating working capital crunch.

- Multiple exemptions: Exempting output without refunding input taxes leading to hidden tax burden, distortions, and evasion risks.

- Delay in GST Tribunals: Non-establishment of GST Appellate Tribunals is forcing taxpayers to approach High Courts leading to backlogs and delayed justice.

Next Gen GST Reform:

Development-Oriented Structural Reform:

- Correction of inverted duty structures to reduce working capital blockage.

- Enhances competitiveness of domestic manufacturing which supports Atmanirbhar Bharat.

Rate Rationalisation: Two-Slab System:

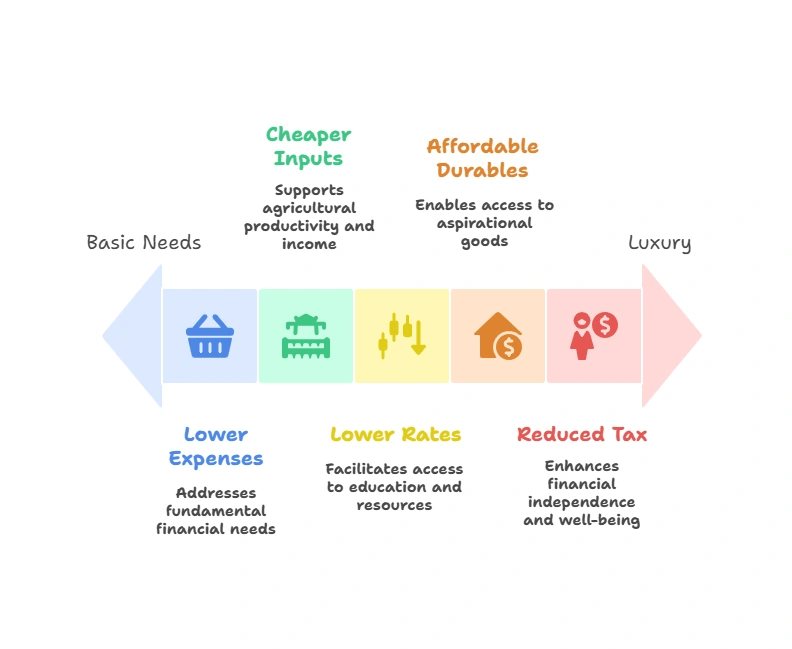

- Simplified from 4 slabs to two slabs: 5% and 18%.

- Shifts:

- 99% of items in 12% slab: 5%.

- 90% of goods in 28% slab: 18%.

- Impact:

- Essentials such as food items, toiletries, packaged goods etc will get cheaper.

- Consumer durables such as ACs, refrigerators, TVs may become affordable.

Ease of Living and Business:

- Tech-driven simplification: Pre-filled returns, automated refunds.

- Support to MSMEs/startups: Lower compliance cost, faster ITC availability.

Significance of reforms:

GST Council as the Reform Engine:

- Decision-making body: It consists of both Union Finance Minister and State Finance Ministers.

- Voting:

- Centre → 1/3rd weightage.

- States collectively → 2/3rd weightage.

- Decision requires 3/4th majority.

- It reflects cooperative federalism in fiscal policy.

Global Comparisions:

- International lessons: Australia (10% single rate), New Zealand (15% single rate). It shows that simpler GST entails more efficiency.

- India’s hybrid model: Retains flexibility with special rates (gems/jewellery) and high rate for sin goods (40%).

- Global competitiveness: Improves India’s attractiveness for investment and trade.

Way forward for reforms:

- Consensus building: By institutionalising Centre–State dialogue to ensure revenue balance.

- Robust technology: Ensure smooth compliance and refund processing.

- Market pass-through: Monitor whether businesses actually reduce prices for consumers.

Conclusion:

By simplifying rates, correcting structural flaws, and reducing compliance burdens, it strengthens Atmanirbhar Bharat and paves the way for India’s transition into a developed nation by 2047. Its success will depend on cooperative federalism, technology readiness, and ensuring benefits reach the common citizen.

La Excellence IAS Academy, the best IAS coaching in Hyderabad, known for delivering quality content and conceptual clarity for UPSC 2025 preparation.

FOLLOW US ON:

◉ YouTube : https://www.youtube.com/@CivilsPrepTeam

◉ Facebook: https://www.facebook.com/LaExcellenceIAS

◉ Instagram: https://www.instagram.com/laexcellenceiasacademy/

GET IN TOUCH:

Contact us at info@laex.in, https://laex.in/contact-us/

or Call us @ +91 9052 29 2929, +91 9052 99 2929, +91 9154 24 2140

OUR BRANCHES:

Head Office: H No: 1-10-225A, Beside AEVA Fertility Center, Ashok Nagar Extension, VV Giri Nagar, Ashok Nagar, Hyderabad, 500020

Madhapur: Flat no: 301, survey no 58-60, Guttala begumpet Madhapur metro pillar: 1524, Rangareddy Hyderabad, Telangana 500081

Bangalore: Plot No: 99, 2nd floor, 80 Feet Road, Beside Poorvika Mobiles, Chandra Layout, Attiguppe, Near Vijaya Nagara, Bengaluru, 560040