Paper: GS – III, Subject: Economy, Topic: Inflation, Issue: Inflation.

Context:

Inflation in India has dropped sharply over the past year, reaching historic lows with the Consumer Price Index (CPI) at 2.07% in August 2025 and the Wholesale Price Index (WPI) inflation at just 0.52%.

Key Takeaways:

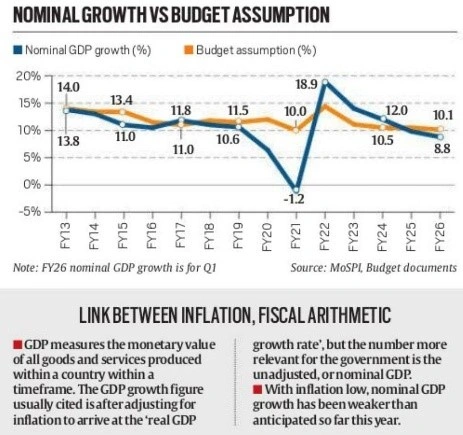

- While this is good news for consumers as it eases the cost of living, it poses significant challenges for the government’s fiscal management, particularly related to nominal GDP growth and budget targets.

- This paradox of low inflation being both a boon for households yet a challenge for government finances makes it important to understand its broader economic implications.

What is Inflation?

- Inflation is a gradual loss of purchasing power that results in a significant increase in the prices of goods and services over time.

- The inflation rate is calculated by averaging the price increases of a basket of selected goods and services over a year. High inflation means that prices are rising rapidly, whereas low inflation means that prices are rising more slowly.

- Deflation: Inflation can be distinguished from deflation, which occurs when prices fall while purchasing power rises.

- Inflation measurement: Done using indices that track price changes in a basket of goods and services over time, relative to a base year.

- Wholesale Price Index (WPI) Tracks wholesale market price changes (goods traded between companies).

- Excludes services.

- Published monthly by the Office of Economic Adviser, DPIIT.

- Base year: 2011–12.

Consumer Price Index (CPI):

- Measures changes in consumer-level prices of goods and services.

- Widely used by policymakers, markets, and businesses.

- Published by the Central Statistics Office of the Ministry of Statistics and Programme Implementation

Producer Price Index (PPI):

- Captures price changes from the producer’s perspective.

- Reflects input cost pressures that may later affect retail prices.

- Not focused on consumer prices.

GDP Deflator:

- Broadest measure of inflation; covers all domestically produced goods and services.

- Formula: GDP Deflator (Nominal GDP ÷ Real GDP) × 100.

- Flexible: no fixed base year or basket, allows cross-period comparisons.

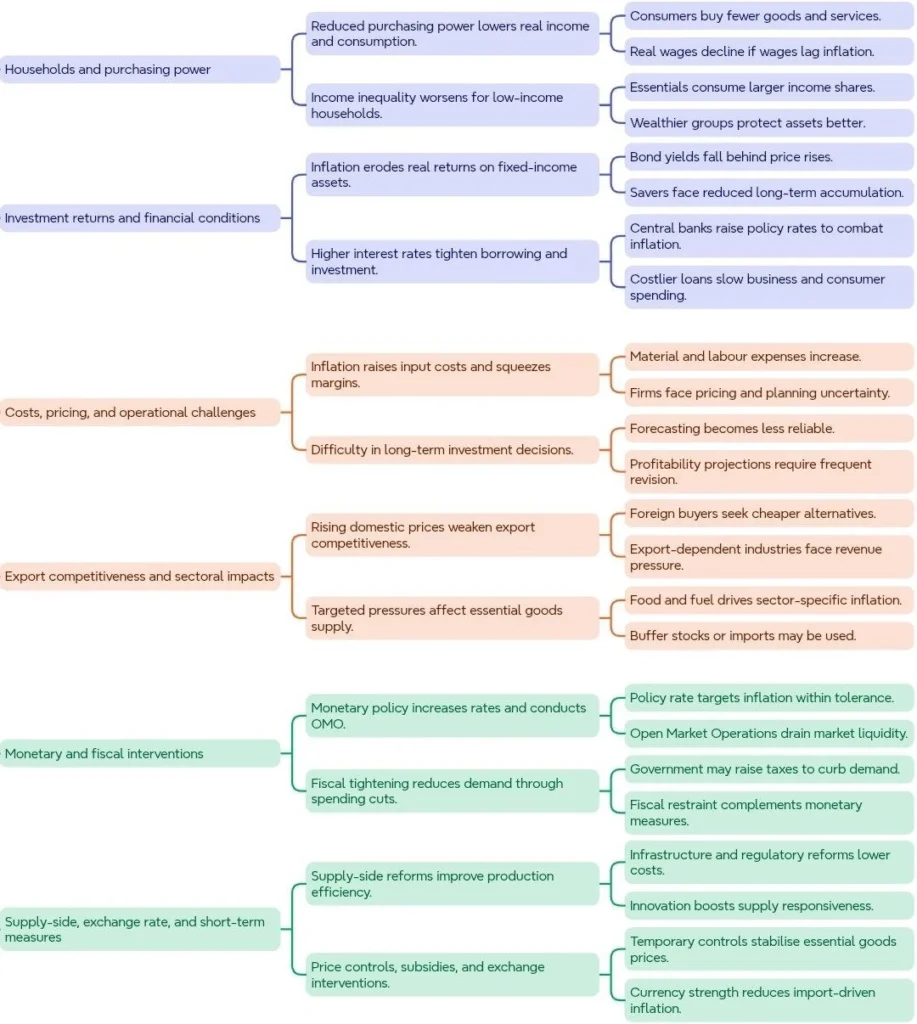

Inflation Impacts and Control Measures:

Low inflation benefits consumers but slows nominal GDP growth, straining government revenues and fiscal targets. Balanced policies strengthening revenues, boosting investment, and ensuring prudent monetary coordination are essential to sustain growth without triggering inflationary pressures.

La Excellence IAS Academy, the best IAS coaching in Hyderabad, known for delivering quality content and conceptual clarity for UPSC 2025 preparation.

FOLLOW US ON:

◉ YouTube : https://www.youtube.com/@CivilsPrepTeam

◉ Facebook: https://www.facebook.com/LaExcellenceIAS

◉ Instagram: https://www.instagram.com/laexcellenceiasacademy/

GET IN TOUCH:

Contact us at info@laex.in, https://laex.in/contact-us/

or Call us @ +91 9052 29 2929, +91 9052 99 2929, +91 9154 24 2140

OUR BRANCHES:

Head Office: H No: 1-10-225A, Beside AEVA Fertility Center, Ashok Nagar Extension, VV Giri Nagar, Ashok Nagar, Hyderabad, 500020

Madhapur: Flat no: 301, survey no 58-60, Guttala begumpet Madhapur metro pillar: 1524, Rangareddy Hyderabad, Telangana 500081

Bangalore: Plot No: 99, 2nd floor, 80 Feet Road, Beside Poorvika Mobiles, Chandra Layout, Attiguppe, Near Vijaya Nagara, Bengaluru, 560040