Why?

The failure of private investment, as measured by private Gross Fixed Capital Formation (GFCF), to pick up pace has been one of the major issues plaguing the Indian economy.

Approach:

- Introduce your answer by defining Private GFCF as net investment by the private sector in fixed assets crucial for expanding economic capacity, enhancing productivity, and ensuring sustained growth.

- In the main body, discuss causes like low consumer spending and policy uncertainty; explore implications such as reduced competitiveness and job creation; assess government actions like tax cuts and infrastructural investments.

- Conclude by emphasizing the necessity of consistent, comprehensive policies to restore private investment, vital for India’s long-term economic health and stability.

Answer:

Private Gross Fixed Capital Formation (GFCF) refers to the net investment in fixed capital by the private sector within an economy. This includes building new plants, machinery, and infrastructure. A high GFCF is crucial for economic growth as it expands the productive capacity of the economy, leading to higher output and improved living standards. The failure of private investment, as measured by private Gross Fixed Capital Formation (GFCF), to pick up pace has been one of the major issues plaguing the Indian economy.

Causes for the Decline in Private Gross Fixed Capital Formation (GFCF):

- Low Consumption Expenditure:Businesses hesitate to invest if they perceive a lack of future demand for their products due to weak domestic consumption.

- However, historical data in India shows an inverse relationship at times between private investment and domestic consumption.

- Stagnant Reforms and Policy Uncertainty: since the early 2010s have discouraged long-term investments. Businesses require a stable and predictable policy environment to make risky, long-term investment decisions.

- Stressed Banking System: High levels of NPAs in the banking system have made banks cautious about lending to the private sector. This restricts credit availability, especially for smaller businesses, and hinders their ability to invest and expand.

- Infrastructural Bottlenecks: Inadequate infrastructure, such as power, transportation, and logistics, increases the cost of doing business and discourages investments.

- Skill Mismatch: A skills gap in the workforce can make it difficult for businesses to find qualified personnel. This can discourage investment in certain sectors.

- Global Factors: A weak global economic environment, rising geopolitical tensions and trade wars can impact demand for Indian exports, reducing business confidence and investment.

Implications for India’s Economic Growth:

- Long-term Growth Prospects: Sustained decline in private GFCF limits the expansion of productive capacity and technological advancements, directly affecting GDP growth rates, living standards and economic stability.

- According to Economic Survey, a 1% increase in GFCF is associated with an approximate 0.4% increase in GDP growth.

- Employment and Wage Impacts: A slowdown in private investment leads to fewer employment opportunities, affecting income levels and consumer demand.

- According to CMIE, periods of investment slowdown often correlate with higher unemployment rates and stagnant wage growth, as seen during the post-2011 slowdown.

- Impact on Competitiveness: With lower investment, Indian businesses risk losing their competitive edge both domestically and internationally.

- Indian manufacturing firms fail to compete effectively with firms from ASEAN countries where higher rates of capital formation are common.

- Fiscal Pressure on Government: to fill the investment gap. This can lead to higher public sector borrowing, leading to concerns about fiscal deficits and debt sustainability.

- Public sector investment has often increased in years following a decline in private GFCF.

- Sectoral Shifts and Structural Changes: A reduction in private GFCF can lead to sectoral imbalances where certain industries fall behind due to underinvestment. This can alter the economic structure in the long run, potentially leading to inefficiencies and economic vulnerabilities.

Assessment of the Measures Taken by the Government to Revive Private Investment:

- Corporate Tax Reduction: In 2019, the government reduced the corporate tax rate from 30% to 22% for existing companies and to 15% for new manufacturing firms, aiming to increase cash flows and incentivize reinvestment.

- This has boosted the profitability and cash reserves of companies but its effect on actual reinvestment in GFCF has been mixed due to uncertain demand and global scenario.

- Atmanirbhar Bharat Abhiyan: This broad-ranging policy initiative, launched in response to the COVID-19 pandemic, includes measures to support SMEs, promote sector-specific industries, and improve the ease of doing business.

- Successful in providing immediate relief to businesses through credit guarantees and fiscal support. However, its long-term impact on enhancing GFCF is yet to be fully realized.

- Initiatives like the Production Linked Incentive (PLI) scheme have shown promise in attracting new investments in sectors such as electronics and pharmaceuticals.

- Infrastructure Push: Significant public investment in infrastructure, including roads, railways, and urban infrastructure, is intended to stimulate economic activity and create a multiplier effect that encourages private investment.

- The National Infrastructure Pipeline (NIP) aims to invest ₹111 lakh crores over 2020-25.

- Crowding-out effect, where government borrowing limits private sector access to capital, remains a concern.

- Reforms in Labour and Land Acquisition Laws: While some states have embraced these reforms, translating them into increased private investment rates across the board has been slow.

Addressing the decline in private GFCF is crucial for safeguarding India’s economic future. Effective policy measures that boost investor confidence, reduce economic uncertainty, and stimulate consumer demand are essential to revive private investment and sustain economic growth.

‘+1’ Value Addition:

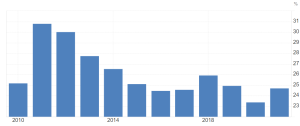

Gross fixed capital formation, private sector (% of GDP) in India was reported at 24.71 % in 2021, according to the World Bank collection of development indicators.