Syllabus: GS-II, Polity and Governance;

Context: With the G-20 countries agreeing to explore a coordinated regulatory framework for crypto assets, India could wait a while longer before firming up its domestic regulations for cryptocurrencies, and initiate a dialogue with stakeholders on the way forward.

Synopsis:

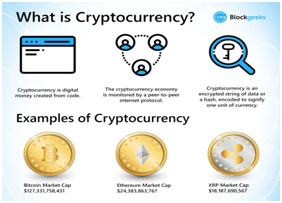

What is Crypto currency?

- Cryptocurrency is a type of digital or virtual currency that uses cryptography for security.

- Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies are decentralized and typically operate on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

key characteristics and concepts related to cryptocurrencies:

- Decentralization: Cryptocurrencies are not controlled by a central authority, such as a government or a central bank. Instead, they rely on a decentralized network of computers (nodes) to validate and record transactions.

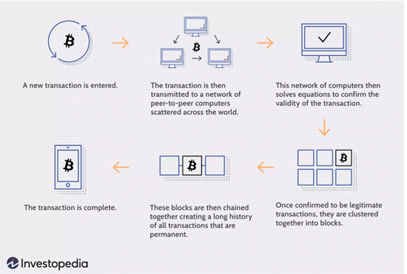

- Blockchain Technology: The blockchain is maintained by a distributed network of nodes, and new transactions are added to it in a secure and chronological order.

- Digital Ownership: When you own cryptocurrency, you have a digital wallet that stores cryptographic key These keys are used to prove ownership and authorize transactions on the blockchain.

- Security: Cryptocurrencies use cryptographic techniques to secure transactions and control the creation of new units.

- Transparency: Blockchain technology provides transparency, as all transactions are recorded on a public ledger that anyone can access and verify.

- Pseudonymity: Cryptocurrency transactions are typically conducted using alphanumeric addresses rather than real-world identities.

- Limited Supply: Many cryptocurrencies have a limited supply or a cap on the total number of coins that can ever be created. For example, Bitcoin has a maximum supply of 21 million coins. This limited supply can influence their value.

- Volatility: Cryptocurrency prices can be highly volatile, with significant price fluctuations over short periods. Factors like market sentiment, adoption, regulatory developments, and macroeconomic conditions can impact prices.

- Regulation: The regulatory environment for cryptocurrencies varies by country and is subject to ongoing developments. Some countries have embraced cryptocurrencies, while others have imposed strict regulations or outright bans.

Crypto-regulation in India:

The Indian government had expressed concerns about the potential risks associated with cryptocurrencies, such as money laundering, fraud, and the use of cryptocurrencies for illegal activities. However, there was no clear and comprehensive regulatory framework in place for cryptocurrencies at that time.

- Reserve Bank of India (RBI) Ban and Supreme Court Overturn: In April 2018, the Reserve Bank of India (RBI), which is India’s central bank, issued a circular prohibiting banks and financial institutions from providing services to cryptocurrency businesses and individuals. This effectively banned the use of banking channels for cryptocurrency transactions.

- SC struck down the ban: However, in March 2020, the Supreme Court of India quashed this ban, stating that it was disproportionate.

- Interministerial Committee: Following the Supreme Court’s decision, there were discussions within the Indian government about regulating cryptocurrencies. An interministerial committee was formed to examine the issues and propose a regulatory framework.

- Draft Cryptocurrency Bill: In 2019, a draft bill called the “Banning of Cryptocurrency and Regulation of Official Digital Currency Bill” was leaked. This bill proposed a ban on all cryptocurrencies in India, except for a digital rupee issued by the RBI. However, this bill was not officially introduced in Parliament at that time.

- Public and Industry Input: The government sought public and industry input on cryptocurrency regulation, and there were various consultations and discussions.

- Blockchain and Crypto Associations: Several blockchain and cryptocurrency industry associations in India continued to advocate for a more balanced and conducive regulatory environment.

- 2021: Cryptocurrency and Regulation of Official Digital Currency Bill, 2021 introduced.

- Under this, a plan to ban private digital currencies favours RBI backed currency.

- A 3-6 month exit period prior to banning the trading, mining and issuing of cryptos.

- Finally, Cryptocurrencies, though unregulated, are not illegal in India.