Syllabus: GS-III

Subject: Economy & Development

Topic: Government Budgeting

Issue: GST Evasion.

Context: GST authorities expose 29,273 bogus firms, evading Rs 44,015 crore since May ’23; Maharashtra and Delhi top the list.

Synopsis:

- 29,273 bogus firms uncovered for GST evasion of Rs 44,015 crore since May ’23.

- Maharashtra tops with 926 bogus firms evading Rs 2,201 crore; Delhi reports higher evasion at Rs 3,028 crore by 483 firms.

- Haryana leads fake firms per lakh registered firms, followed by Delhi, Rajasthan, and Maharashtra.

- Oct-Dec ’23: 4,153 bogus firms found evading Rs 12,036 crore in input tax credit.

- Central GST authorities detect 2,358 bogus firms, protecting revenue of Rs 1,317 crore.

- Special drive since May ’23 exposes 29,273 bogus firms, saving Rs 4,646 crore.

- Measures include biometric-based Aadhaar authentication, sequential filing of GST returns, and data analytics for fraud detection.

Background:

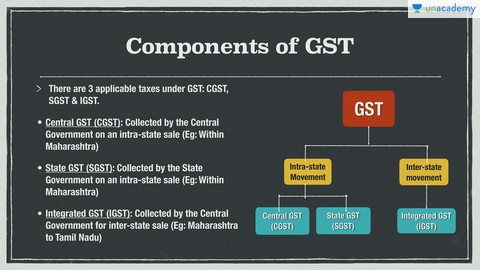

A value-added tax for domestic consumption, impacts the supply side, employs destination-based taxation, and has dual GST with multiple rates. Legislative basis lies in the 2016 Constitution (101st Amendment) Act.

For trade and industry, it simplifies the tax regime, eases business, and increases competitiveness. Consumers benefit from transparent prices and potential reductions. States experience an expanded tax base, economic empowerment, and increased compliance. Exemptions include customs duty on imports, petroleum, tobacco products, excise duty on liquor, stamp duty, and electricity taxes.

The GST Council, chaired by the Union Finance Minister, oversees tax reforms. It creates a unified market, reduces corruption, and stimulates the secondary sector

Conclusion: The continuous evolution of the GST system and the emergence of new evasion methods necessitate constant vigilance, adaptivity, and a commitment to ongoing reforms.