Paper: GS – III, Subject: Economy, Topic: Financial Markets, Issue: Crypto regulation scenario in India.

Context:

There is an urgent need for a comprehensive regulatory framework for cryptocurrencies in India focusing on investor protection, market transparency, and the global regulatory race in digital assets.

Key Highlights:

Recent Incidents:

- Security breach: A crypto exchange suffered a $44 million hack.

- WazirX lost $23.4 million in 2023. These incidents show the dangers of an unregulated ecosystem.

Potential of Digital Assets:

- Huge potential: Digital asset market can reach $2 trillion by 2028 (Standard Chartered).

- Reliable mode: Crypto payments and stablecoins may become routine tools for transfers, payments and financial innovation.

Arguments Against Crypto Ban:

- Crypto is too big and mainstream to ban outright.

- Investors have already moved to private wallets.

- UPI and e-rupee may cover payment functions but not investment functions of crypto.

India’s Position on Global Crypto Adoption:

India leads in global crypto adoption in 2024. As Chainalysis report:

- India has 119 million investors, constituting 20% of global crypto holders.

- Retail investors dominate: 90–95% of users but only 30–50% of trading volume.

- Whereas High Net-Worth Individuals (HNIs) and institutions constitute just 4–10% of users and drive 50–70% of exchange turnover.

- US: 53 million investors while Indonesia has 39 million.

- Though India’s crypto investor base is massive it lacks regulatory safeguards. This regulatory void has led to the proliferation of crypto exchanges.

India’s Regulatory Vacuum:

- Lack of clear framework: No clear framework to regulate cryptocurrencies.

- Lack of legal clarity: Government quick to tax crypto profits, but slow on legal clarity or investor protection.

- Incoherent approach: S.C. Garg (former Finance Secretary) stated that India’s crypto policy is piecemeal, passive, and unsustainable.

International regulatory developments:

- US passed the Genius Act for stablecoin regulation emphasising on stablecoins backed by liquid assets (e.g., US Treasury bills). It mandates Monthly reserve disclosures to enhance credibility.

Way ahead:

Regulatory Action: Government & RBI should fill the regulatory vacuum collaboratively.

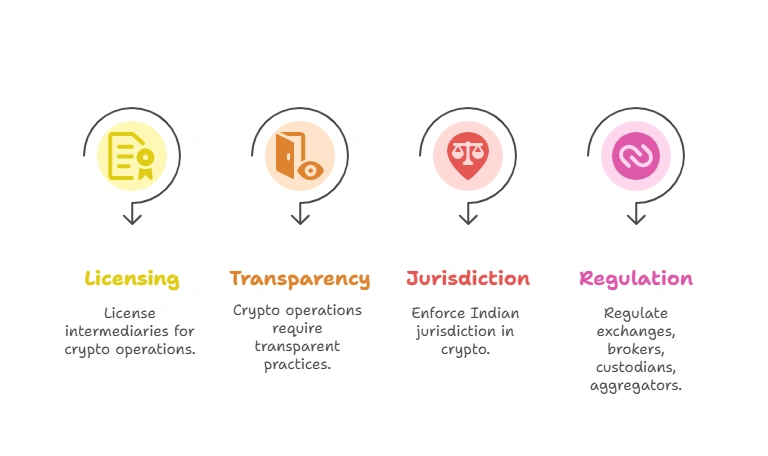

Key Pillars of Crypto Framework (as suggested by S.C. Garg):

Conclusion:

Delays in regulation could lead to massive investor risks. A structured crypto framework would support innovation protect retail investors. and strengthen India’s position in the global digital economy.

La Excellence IAS Academy, the best IAS coaching in Hyderabad, known for delivering quality content and conceptual clarity for UPSC 2025 preparation.

FOLLOW US ON:

◉ YouTube : https://www.youtube.com/@CivilsPrepTeam

◉ Facebook: https://www.facebook.com/LaExcellenceIAS

◉ Instagram: https://www.instagram.com/laexcellenceiasacademy/

GET IN TOUCH:

Contact us at info@laex.in, https://laex.in/contact-us/

or Call us @ +91 9052 29 2929, +91 9052 99 2929, +91 9154 24 2140

OUR BRANCHES:

Head Office: H No: 1-10-225A, Beside AEVA Fertility Center, Ashok Nagar Extension, VV Giri Nagar, Ashok Nagar, Hyderabad, 500020

Madhapur: Flat no: 301, survey no 58-60, Guttala begumpet Madhapur metro pillar: 1524, Rangareddy Hyderabad, Telangana 500081

Bangalore: Plot No: 99, 2nd floor, 80 Feet Road, Beside Poorvika Mobiles, Chandra Layout, Attiguppe, Near Vijaya Nagara, Bengaluru, 560040