Syllabus: GS-II

Subject: Governance

Topic: Welfare schemes for vulnerable sections.

Issue: Pension Scheme.

Context: Maharashtra cabinet approves one-time option for state govt employees joining after Nov 2005 to opt for Old Pension Scheme (OPS).

Synopsis:

- Move addresses a long-standing demand but has a limited scope, benefiting a specific group of employees.

- Decision follows protests by employees demanding restoration of OPS.

- Benefits 26,000 employees selected before Nov 2005 but receiving joining letters later.

- OPS discontinued in 2005, offers monthly pension without employee contributions.

- Employees have six months to choose OPS or stick with New Pension Scheme, with a two-month document submission deadline.

Background:

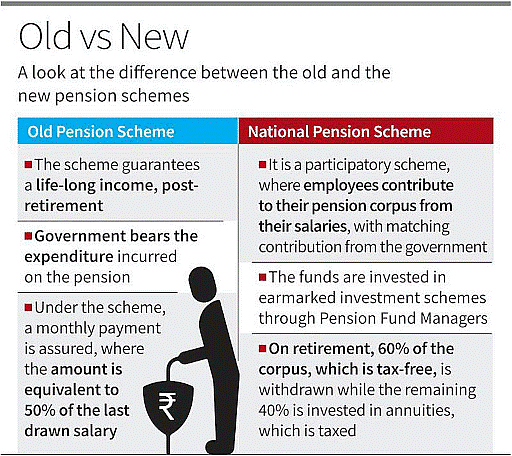

Old Pension Scheme (OPS):

- OPS assured government employees a pension of 50% of their last drawn salary.

- Described as a ‘Defined Benefit Scheme,’ it provided a defined and secure retirement benefit.

- Discontinued by the Central government in 2003.

Concerns with OPS:

- Unfunded pension liability led to no specific corpus for continuous payouts.

- ‘Pay-as-you-go’ scheme caused inter-generational equity issues, burdening the present generation with the rising pensioner costs.

- Lack of a clear plan for future funding prompted the discontinuation of OPS in 2003.

What is New Pension Scheme (NPS)?

- NPS, introduced in April 2004, replaced OPS by the Central government.

- Open to employees in public, private, and unorganized sectors, excluding the armed forces.

- Administered by the Pension Fund Regulatory and Development Authority (PFRDA).

- Eligibility: Indian citizens aged 18-60, including NRIs.

- Minimum annual contribution: Rs. 6,000; failure to contribute results in account freezing.

Conclusion: OPS, with its defined benefit of 50% last drawn salary, provided assurance to government employees but faced challenges like unfunded pension liability and inter-generational equity issues, leading to its discontinuation in 2003.