Syllabus: GS-III

Subject: Economy

Topic: Taxation

Issue: Direct Taxes.

Context: India’s net direct tax collections rose by 20.25%.

Prelims Connect (Terms in News):

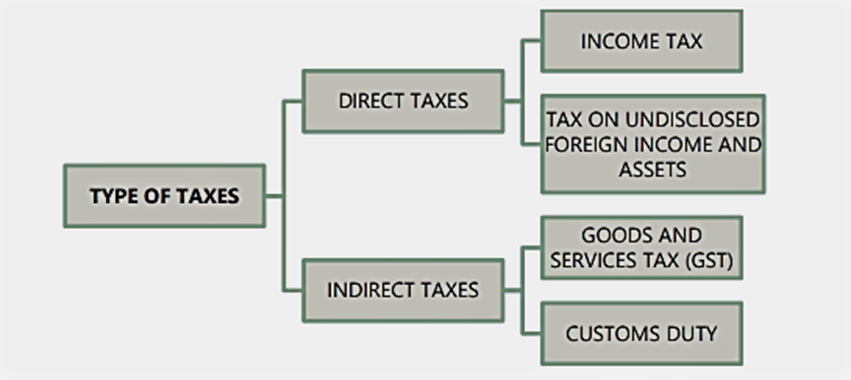

| Personal Income Tax: · This tax is imposed by the government on an individual’s income. · Most individuals do not pay the individual income tax on the full amount of income due to tax exemptions, deductions, and credits. Corporate Income Tax: · It is called company tax or corporation tax and is a direct tax levied on a company’s income or capital by the government. Direct Tax: · A direct tax is imposed directly upon the taxpayer and is paid by individuals directly to the Government. · The Central Board of Direct Taxes is responsible for levying and collecting. Indirect Tax: · End users pay these taxes; everyone pays the same amount of indirect taxes. · Transfer of liability is possible in indirect tax.

Continue Reading

Scroll to Top

WhatsApp us |