Syllabus: GS-II

Subject: Polity

Topic: Federalism ,

Issue: Financial relation

Southern state have raised issue of not receiving proper share in financial devolution:

- Divisible pool of taxes are defined in article 270 of constitution divided as per recommendation of Finance Commission(Article 280)

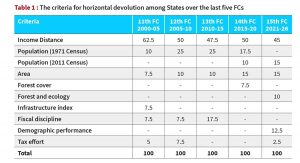

· Income distance’ is the distance of a State’s income from the State with highest per capita income which is Haryana.

· ‘Population’ is the population as per the 2011 Census.(from 15th FC)

· ‘Forest and ecology’ consider the share of dense forest of each State in the aggregate dense forest of all the States.

· ‘The demographic performance’ criterion has been introduced to reward efforts made by States in controlling their population.

· ‘Tax effort’ as a criterion has been used to reward States with higher tax collection efficiency.