Special Category Status

Why in The News?

Bihar Chief Minister Nitish Kumar reiterated the demand for special status in Bihar, citing its backwardness, huge population, poverty, and lowest per capita income.

Special Category Status:

- It is a designation conferred by the Central government to states facing socio-economic and geographic disadvantages, aiming to facilitate their development.

Historical Context and Decision-Making:

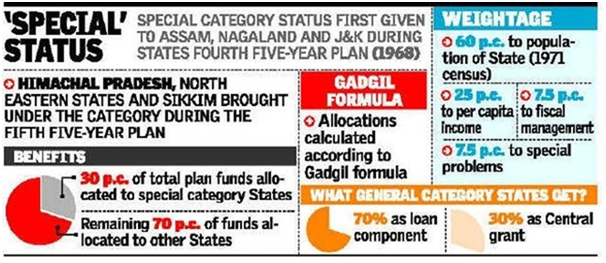

- Origins in 1969 by the Fifth Finance Commission

- Absence in the Constitution

- Aimed at historically disadvantaged states with inherent challenges.

- Jammu and Kashmir (now union territories), Assam, and Nagaland being the pioneering states granted this status under the chairmanship of Mahavir Tyagi

- Initial authority with the National Development Council (NDC)

- Shift to the discretion of the ruling party at the Centre with the advent of NITI Aayog.

- Inclusion of variables like “forest cover” by the 14th Finance Commission

—the classification aimed to address the socio-economic and geographic challenges these states faced.

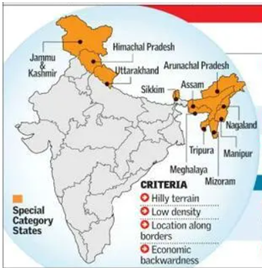

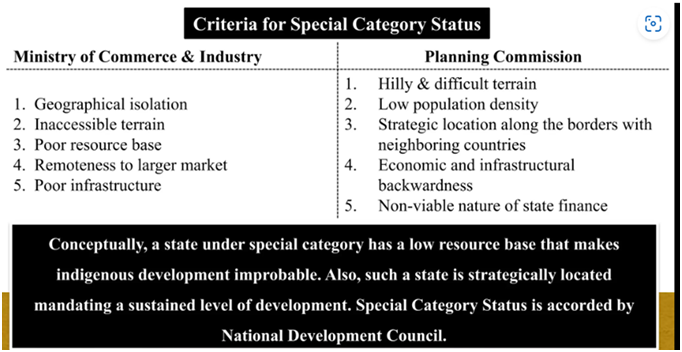

Criteria for Special Category Status:

- Hilly and challenging terrain.

- Strategic border locations.

- Low per capita income and low population density.

- Sizable tribal populations.

- Economic and infrastructure backwardness, and

- Non-viable state finances.

This distinction aims to ensure uniform growth, equality, and inclusive development.

| States currently Holding Special Category Status: 11 states, Assam, Nagaland, Himachal Pradesh, Manipur, Meghalaya, Sikkim, Tripura, Arunachal Pradesh, Mizoram, Uttarakhand, and Telangana. |

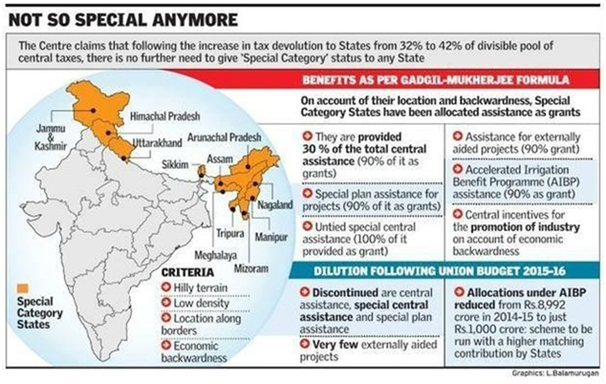

Benefits Associated with Special Category Status:· Central government covering 90% of state expenditures for centrally sponsored programs.

|

Financial Assistance:

- Normal Central Assistance (NCA), Additional Central Assistance (ACA), Special Central Assistance (SCA)

- Preferential allocation: 30% to special category states, 70% to others

- Composition of assistance: 90% grants and 10% loans for special category states

Additional Concessions:

- Excise and customs duties, income tax rates, corporate tax rates

Specific Assistance:

- Targeted programs for hill areas, tribal sub-plans, and border areas

Evolution of Central Approach:

- Role of NITI Aayog and 14th Finance Commission

- Increased devolution of divisible pool to all states

- Controversy around demand for Special Category Status by certain states.

Recent Developments and Controversies:

- Demands from states like Bihar and Andhra Pradesh

- Clarifications from the 15th Finance Commission

- Shift in the narrative post-14th Finance Commission recommendations

Understanding India’s Federal Structure: India, a “union of states” with 29 states and 7 union territories, periodically allocates a portion of the central government’s revenues to these entities based on recommendations from the Finance Commission.

Constitutional Provision: Article 275 of the Indian Constitution empowers the central government to provide additional financial assistance to any state beyond the Finance Commission’s recommendations. Currently, 11 states hold the Special Category Status, while five others seek this designation.

Benefits Associated with Special Category Status: The advantages conferred on states with SCS include:

- Central government covering 90% of state expenditures for centrally sponsored programs.

- 10% provided as a zero-interest loan.

- Special consideration in government funding applications.

- Reductions in excise taxes to attract businesses.

- Access to 30% of the total federal budget.

- Programs for debt reduction and debt exchange.

- Exemption from various taxes to encourage investment.

Top of Form

Concerns:

- Dilution of Benefits:

Special status to new states may dilute benefits as broader distribution might reduce assistance and privileges.

- Modest Current Benefits:

Existing system benefits are deemed modest as support may not sufficiently address state challenges.

Conclusion:

- Abolition of Special Category Status:

The 14th Finance Commission abolished “special category status, to promote equitable resource distribution and balanced development.

- Increased State’s Share of Tax Receipts:

State’s share has increased from 32% to 42% since 2015,to Enhance state financial base for development and bridge resource gaps.

Top of Form

Prelims Question:

Consider the following statements regarding the Special Category Status in India:

- The concept of Special Category Status originated in 1969 under the recommendations of the Sixth Finance Commission.

- According to the information provided, “forest cover” was introduced as a variable impacting the classification of states under Special Category Status by the 14th Finance Commission.

- The criteria for Special Category Status include high population density, economic and infrastructure backwardness, and viable state finances.

Which of the statements is/are correct?

a) Only One Statement.

b) Only Two Statements.

c) Only Three Statements.

d) None.

Expected Mains Question?

Critically evaluate the concerns associated with granting Special Category Status to states, especially in light of potential dilution of benefits. Discuss the counterarguments regarding the modest benefits under the current system.