Carbon Border Adjustment Mechanism (CBAM)

Context:

The European Union’s plan to impose a Carbon Tax on imports is criticized as a harmful move that could seriously harm its manufacturing sector.

What is Carbon Border Adjustment Mechanism (CBAM)?

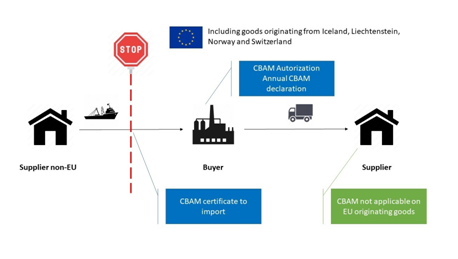

CBAM is a way for the EU to charge a fee on imports of certain goods from outside the EU based on their carbon emissions.

This is the world’s first carbon border tax. Its main goal is to prevent ‘carbon leakage.’

Origin: CBAM is part of the European Green Deal, guiding the EU’s efforts to become climate-neutral by 2050.

Features of CBAM (Carbon Border Adjustment Mechanism):

- “Fit for 55” Policy: Proposed in 2021 as part of the “Fit for 55” package, CBAM aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels.

- Import Tax: CBAM introduces an import tax or tariff on certain carbon-intensive goods entering the European Union.

- Emissions Assessment: It assesses the carbon emissions associated with the production of imported goods, aiming to account for their environmental impact.

- Compliance Requirements: From 2026, EU importers must buy carbon certificates based on EU carbon pricing rules, as if the product had been produced in the EU.

- Gradual Implementation: CBAM will be introduced in stages, with a focus on specific industries initially.

Objectives of CBAM:

- Carbon Emission Reduction: CBAM’s primary objective is to encourage emission reductions in industries outside the EU by making carbon-intensive imports more expensive.

- Climate Neutrality: CBAM is part of the European Green Deal, guiding the EU’s efforts to become climate-neutral by 2050.

- Protection of EU Industries: CBAM aims to protect EU industries from unfair competition by ensuring that imported goods comply with similar environmental standards.

- Carbon Leakage Prevention: It seeks to prevent carbon leakage, where companies move carbon-intensive production outside the EU to avoid strict climate policies.

- Revenue Generation: CBAM can generate revenue, which may be invested in clean energy or used to support vulnerable consumers and industries within the EU.

Impact of the Carbon Border Adjustment Mechanism (CBAM) on India:

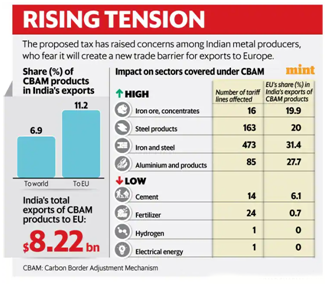

- Higher Tariffs: The CBAM will start by targeting imports of specific goods and key materials with carbon-intensive production, particularly at risk of carbon leakage. These include cement, iron and steel, aluminium, fertilizers, electricity, and hydrogen.

| · About 27% of India’s exports in these sectors go to the EU.· Ex: The tax will lead to a 20-35% tariff on India’s exports of steel, aluminium, and cement, which currently have less than a 3% duty. · This will increase costs resulting in the loss of billions of dollars of exports. |

- Higher Carbon Intensity: Indian products are often more carbon-intensive compared to the EU and other countries because of India’s heavy reliance on coal for energy, particularly in the power sector.

- Coal Dominance: India’s power generation heavily depends on coal (around 75%), much higher than the EU (15%) and the global average (36%). This results in more emissions from products like iron, steel, and aluminium.

- Competitiveness Risk: While initially affecting specific sectors, CBAM’s impact might expand to other areas like refined petroleum products, chemicals, pharmaceuticals, and textiles, which are major imports from India by the EU.

As India lacks its own carbon pricing system, this could affect its export competitiveness compared to countries with existing carbon pricing systems in place.

What Measures can India Take to Mitigate the Impact of CBAM?

- Decarbonization Principle:

Include carbon efficiency in domestic policies like the National Steel Policy and Production Linked Incentive (PLI) to reduce emissions.

- Negotiation for Tax Recognition:

Negotiate with the EU to recognize Indian energy taxes as a form of carbon pricing, making Indian exports less vulnerable to CBAM.

- Transfer of Clean Technologies:

Seek EU support to transfer clean technologies and financing for carbon-efficient production.

- Incentivizing Greener Production:

Encourage cleaner and sustainable production in India to remain competitive in a carbon-conscious future.

- International Advocacy:

Use India’s leadership in the G-20 to advocate against the EU’s carbon tax framework, considering its impact on poorer countries reliant on mineral resources.

Related Concepts:

Carbon Leakage:

EU companies move pollution-heavy production to countries with weaker rules, bringing in more polluting imports instead of EU-made goods.

What is a Carbon Tax?

A carbon tax is a financial charge imposed on the carbon content of fossil fuels, such as coal, oil, and natural gas.

Why Carbon Tax?

A carbon tax is implemented to combat climate change and reduce carbon dioxide (CO2) emissions by making carbon-intensive activities more expensive.

It serves as an incentive for individuals and businesses to transition to cleaner and more sustainable energy sources, ultimately helping to protect the environment.

European Green Deal:

The European Green Deal is a plan to make the EU environment friendly and reach zero climate impact by 2050, while also boosting the economy and improving society.