Paper: GS – III, Subject: Indian Economy, Topic: Taxation, Issue: GST Completing 8 years.

Context:

The celebration of the Goods and Services Tax (GST) completing eight years on July 1 has prompted tax experts to call for significant reforms to enhance its effectiveness and efficiency.

Key Takeaways:

| What are the Goods and Services Tax (GST)? It is an indirect tax which has replaced many indirect taxes in India, such as excise duty, VAT, services tax, etc. The GST Act was passed in Parliament on 29th March 2017 and came into effect on 1st July, 2017. It is a single domestic indirect tax law for the entire country. It is a comprehensive, multi-stage, destination-based tax that is levied on the supply of goods and services, right from the manufacturer to the consumer. Under the GST regime, the tax is levied at every point of sale. In the case of intrastate sales, Central GST and State GST are charged. All the interstate sales are chargeable to the Integrated GST. About GST Council: It is a constitutional body responsible for making recommendations on issues related to the implementation of the Goods and Services Tax (GST) in India. Article 279A of the Indian Constitution gives power to the President of India to constitute a joint forum of the Centre and States called the GST Council, consisting of: Union Finance Minister as Chairperson: The Union Minister of State, in-charge of Revenue of finance The Minister in-charge of finance or taxation, or any other Minister nominated by each State Government. |

Inclusion of Fuel under Goods and Services Tax:

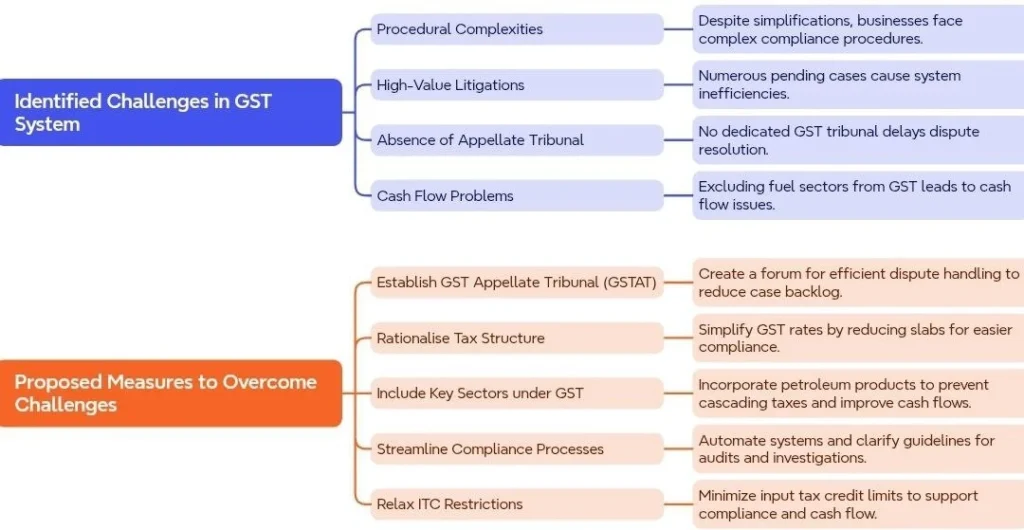

- Current Situation: The Goods and Services Tax law currently has a provision to include petroleum products (petrol, diesel, natural gas, etc.) under its ambit.

- However, this requires approval from the GST Council, which comprises the Union and State Finance Ministers.

- Expert Opinion: Experts strongly advocate for the inclusion of fuel under GST.

- Rationale:

- Reduces Tax Cascading: Excluding fuel leads to significant tax cascading, where taxes are levied on taxes. This increases the overall cost for industries like oil and gas, transportation, and logistics.

- Improves Cash Flow: Inclusion would alleviate cash flow problems for businesses by allowing them to claim input tax credits on fuel purchases.

- PwC Report: A report by PwC emphasizes that the exclusion of petroleum products, which constitute a substantial portion of costs for various industries, results in tax cascading and cash flow issues.

Rationalization of GST Rate Structure:

- Current Situation: The Goods and Services Tax regime currently has multiple tax slabs: 0%, 5%, 12%, 18%, and 28%.

- Additionally, there are special rates of 0.25%, 1%, and 3% for specific goods like gold, silver, and diamonds.

- A Goods and Services Tax Compensation Cess is also levied on items in the 28% slab.

- Expert Opinion: Experts recommend reducing the number of tax slabs to simplify the system.

- Rationale:

- Simplification: Fewer tax slabs would make it easier for businesses to classify goods and services and comply with the tax regulations.

- Reduced Ambiguity: A simpler rate structure would reduce ambiguity and potential disputes related to tax rates.

Minimizing Input Tax Credit (ITC) Restrictions:

- Current Situation: There are various restrictions on availing input tax credit under the Goods and Services Tax law.

- Expert Opinion: Experts suggest minimizing these restrictions to allow businesses to claim ITC more freely.

- Rationale:

- Reduced Costs: Fewer ITC restrictions would reduce the overall cost of doing business.

- Improved Compliance: Simplified ITC rules would encourage better compliance.

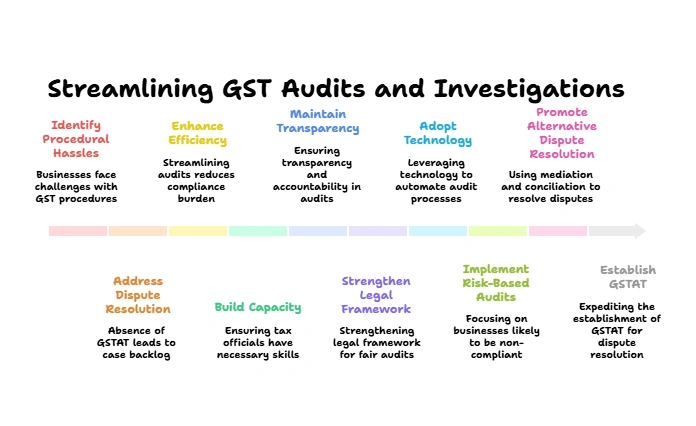

Addressing Key Challenges in Goods and Services Tax Implementation:

Conclusion:

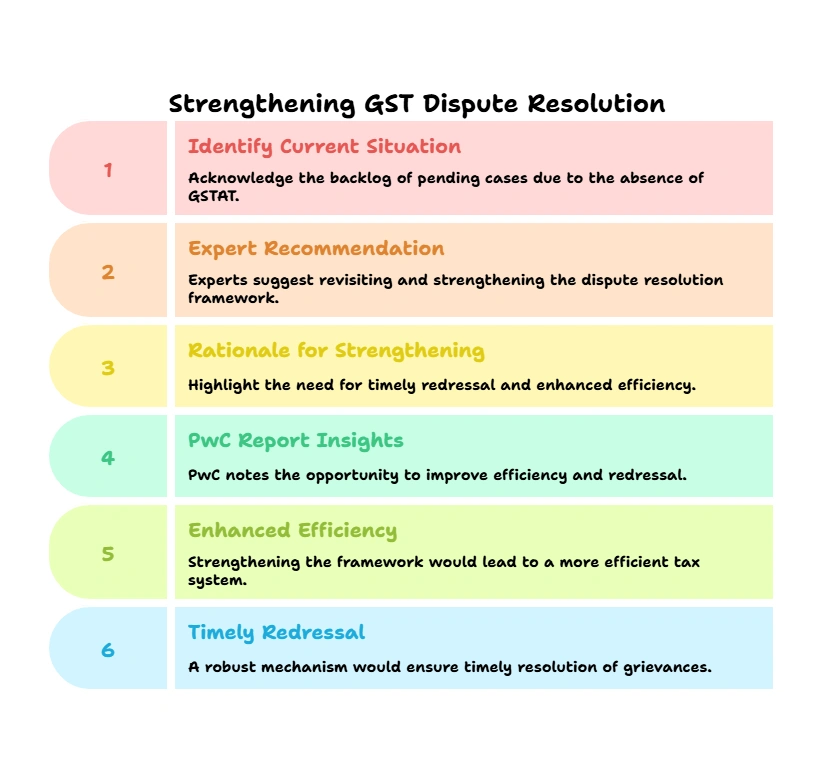

As GST completes eight years, it is crucial to address the identified challenges and implement the suggested reforms. By including fuel under GST, rationalizing the rate structure, streamlining audits, minimizing ITC restrictions, addressing procedural issues, and strengthening the dispute resolution framework, the government can enhance the effectiveness of GST and promote ease of doing business in India.

La Excellence IAS Academy, the best IAS coaching in Hyderabad, known for delivering quality content and conceptual clarity for UPSC 2025 preparation.

FOLLOW US ON:

◉ YouTube : https://www.youtube.com/@CivilsPrepTeam

◉ Facebook: https://www.facebook.com/LaExcellenceIAS

◉ Instagram: https://www.instagram.com/laexcellenceiasacademy/

GET IN TOUCH:

Contact us at info@laex.in, https://laex.in/contact-us/

or Call us @ +91 9052 29 2929, +91 9052 99 2929, +91 9154 24 2140

OUR BRANCHES:

Head Office: H No: 1-10-225A, Beside AEVA Fertility Center, Ashok Nagar Extension, VV Giri Nagar, Ashok Nagar, Hyderabad, 500020

Madhapur: Flat no: 301, survey no 58-60, Guttala begumpet Madhapur metro pillar: 1524, Rangareddy Hyderabad, Telangana 500081

Bangalore: Plot No: 99, 2nd floor, 80 Feet Road, Beside Poorvika Mobiles, Chandra Layout, Attiguppe, Near Vijaya Nagara, Bengaluru, 560040